There IS a better way: Automated Chargeback Management

At this point, the only way to dispute chargebacks and deductions efficiently and successfully is in automating chargeback responses and using similar robotic technology that retailers like Amazon use to create the chargebacks in the first place. It is 100% possible to take your company's SOP and automate the document matching and uploading, the algorithm calculations and data entry required for managing chargeback disputes.

Using cloud robotic automation for chargeback management is a unique solution. The truth is that it is possible to fight technology with technology and win, as was the case for a large book distributor faced with continued profit loss as a result of Amazon chargebacks:

Book Distributor Amazon Deduction Case Study

In about 90 days, a book distributor implemented robotic processing and brought their chargebacks to ZERO. They found themselves current on Amazon chargebacks for the first time EVER, and the cost was minimal compared to traditional manual processing. Truly, automated chargeback management is the only possible way to win with retailer chargeback and deduction disputes, at any kind of volume.

To no one’s great surprise, Amazon is the top retail outlet for book distributors. Amazon was posing increasing problems for a large book distributor by rapidly eating into their already razor thin margins with deductions and chargebacks. The key complaints were:

- Amazon was charging back some amount on nearly a third of the invoices submitted.

- These chargebacks were frequently only pennies on the dollar, but in total amounted to

substantial hits to margin.

- The high volume of the book distributor’s transactions created thousands of chargebacks every

single month.

- Amazon required specific matched paperwork be submitted in order to dispute the chargebacks.

- The paperwork needed was not readily available to attach to transactions on Amazon’s portal.

- Amazon’s chargeback portal was not simple to use. At all.

- Every single chargeback disputed could take between 5 minutes to 15 minutes to submit.

- The book distributor was not able to process the Amazon chargebacks fast enough to fall within

the allowed dispute window.

- Seasonality, after the holidays, made it insurmountable to manage chargebacks as the volumes

were crushing.

Sound familiar?

Manual Chargeback Performed by a Trained Analyst

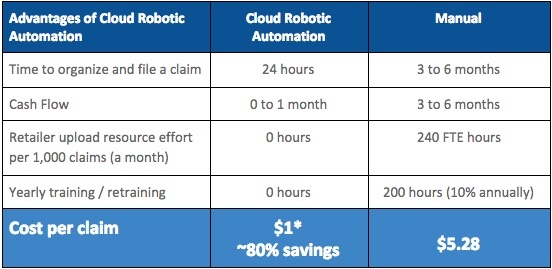

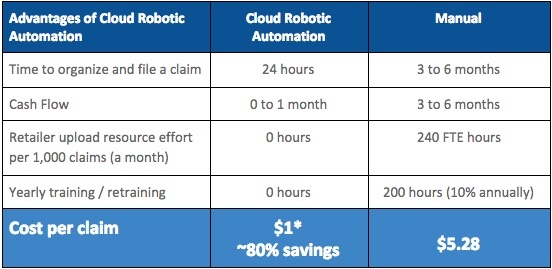

An analysis showed what was required for manual chargeback dispute management at this book distributor, and we found that even a very motivated and trained resource needed on average between 5 to 8 minutes to organize a claim and 5 to 7 minutes to dispute a claim in the Amazon portal. That’s a total of 10 minutes to 15 minutes per claim. The cost per manually processed claim can be easily calculated.

The Solution: An Automated Chargeback Management Tool

A unique solution: Cloud Robotic Automation for Amazon dispute chargeback management that quickly and automatically processes chargebacks. In about 90 days, the book distributor implemented robotic processing and brought their chargebacks to zero. They found themselves current on Amazon chargebacks for the first time EVER. The cost was minimal compared to the manpower costs and mental fatigue surrounding the in-house manual processing of Amazon chargebacks and deductions. Prior to the implementation of cloud robotic automation, all they did was firefight. Now they have time to work with downstream departments like Logistics and Warehouse to discuss and streamline processes, and they are strategizing with Order Management to get a handle on real pricing and back order issues. iNymbus chargeback management solutions proved to be a “must” for our book distributor, in order to keep up with and get ahead of the Amazon portal. The cost savings in time and resources made our automated chargeback management tools a no brainer.

But Amazon isn't the only big retailer causing suppliers and distributors deduction headaches.

Walmart Chargeback Management: A Real Problem

Walmart is constantly deducting money from vendor invoices, and for suppliers or distributors this could equate to thousands of chargebacks per month. The list of reasons why, also known as deduction codes, consists of nearly 100 possible infractions, all of which conclusively reduce your bottom line. When the volume of these deductions is high and they constantly stream in, most distributors simply don’t have the resources and time required to file a claim against every charge. It’s an overwhelming mess that can cost thousands of dollars a month. We looked at two different distributors, each with the same problem: thousands of Walmart deduction claims.

Distributor 1: Video Game Distributor

A direct distributor of video game consoles, accessories, games, and more, this distributor provides retailers nearly every type of product related to the video game world. With Walmart in particular, things had gotten out of hand on the chargeback management front, with the distributor processing up to 1,500 chargebacks monthly. The volume was so high that it required one full-time employee and two interns dedicated to working solely on Walmart chargeback claims to get the job done. To add further stress, Walmart policy states if a deduction is outstanding for two years, they will no longer accept the claim. The distributor had fallen so behind, they were filing deductions with just days to spare. Time management was a major challenge as any issues that may arise with documentation or otherwise, would result in losing the chance of recovering the funds.

Our video game distributor was behind an entire 2 years behind in Walmart chargeback management, but was able to implement automated chargeback mitigation in just 2 weeks and completely catch up on their chargebacks backlog. Today, they continue to process up to 1,500 charebacks per month, all with iNymbus' automated chargeback management services.

Distributor 2: Apparel Distributor

As the producer and distributor of 100+ top sleepwear and loungewear brands, this distributor knows a thing or two about retailer chargebacks. Walmart was particularly burdensome. To more easily deal with Walmart’s volume of chargebacks, a quarterly settlement arrangement was set up between our Distributor and Walmart. The distributor manually completed a spreadsheet with the thousands of open claims, sent it to Walmart, and waited several months for them to review and respond with a proposed settlement amount. This approach worked decently for awhile, until the settlements being offered begin to come in unacceptably low. This left the distributor no choice but to dispute every claim individually. With around 3,000 claims needing to be disputed every quarter, and each claim taking 8 to 15 minutes to complete, there simply was not the man power to even attempt disputing manually.