As a Walmart supplier, every day that your payments are delayed is another day your cash flow suffers. The faster you collect payments, the more capital you have available to reinvest in your business, grow, and stay competitive. One of the key metrics that determine how quickly you can access that capital is Days Sales Outstanding (DSO) — the average number of days it takes to collect payment after a sale.

So, how can you, as a supplier, improve your DSO and unlock cash flow more quickly? In this blog, we’ll walk through actionable strategies and solutions designed to help you reduce your DSO, streamline your receivables process, and keep your business moving forward.

Understanding DSO: Why It Matters for Walmart Suppliers

Days Sales Outstanding (DSO) is a key performance indicator that measures how long it takes for a company to collect payment from customers after a sale. A low DSO means a company is efficiently managing its accounts receivable, ensuring timely cash flow, and reducing reliance on external financing. Conversely, a high DSO can indicate inefficiencies in invoicing, payment processing, or collection.

For Walmart suppliers, optimizing DSO is essential for maintaining liquidity, reducing borrowing costs, and ensuring smooth operations. The faster you can collect payments, the more flexibility you have to invest in new projects, expand operations, or simply run your business more smoothly.

Improving your DSO isn’t just about collecting payments faster; it has far-reaching benefits for your business:

-

Improved Cash Flow: The most immediate benefit is that you’ll have access to more working capital, which means you can reinvest in growth, inventory, and business operations.

-

Reduced Financing Costs: A lower DSO means you rely less on loans or credit to manage cash flow, saving on interest payments and reducing your financial stress.

-

Stronger Supplier-Retailer Relationship: Efficient and timely collections make for smoother business operations, leading to stronger relationships with your retail partners — including Walmart.

-

Operational Efficiency: Automation and streamlined processes allow you to focus on growing your business, not chasing payments or resolving disputes.

Why DSO Can Be a Struggle for Walmart Suppliers

Managing DSO isn’t easy, especially when you're dealing with a retail giant like Walmart. Suppliers face a variety of hurdles that can extend payment cycles, from complex billing processes to delayed deductions. Here are some of the biggest challenges:

-

Extended Payment Terms: Large retailers like Walmart typically negotiate longer payment cycles, meaning suppliers can find themselves waiting longer for payments to come through.

-

High Transaction Volumes: With so many sales happening daily, managing thousands of invoices can quickly become overwhelming. Errors, disputes, and delayed payments can be time-consuming for your DSO.

-

Complex Deductions and Disputes: Walmart’s chargeback system and frequent disputes can tie up payments for weeks or even months, pushing DSO higher than it should be.

Concrete Strategies to Improve DSO

Now that we’ve learned about the challenges, it’s time to focus on how you can improve your DSO. Here are the most effective strategies to speed up your cash collection process and reduce DSO:

1. Implement Electronic Invoicing and Payments

The faster you can invoice processing and track payments, the quicker you can collect what you're owed. Implementing automated invoice processing allows you to send invoices immediately, track them in real-time, and easily spot overdue payments.

Electronic payments, such as ACH transfers, can also significantly reduce delays associated with traditional payment methods, helping you to get the collection faster and improve your overall DSO.

2. Negotiate Walmart Payment Terms

While large retailers have the upper hand in negotiations, suppliers can still push for favorable payment terms. Here’s how:

-

Request Early Payment Discounts: If possible, offer a discount for early payments. This incentivizes Walmart to pay you faster, reducing your DSO.

-

Flexible Terms: Depending on your business relationship, see if you can adjust payment terms or set up a structured payment schedule that works in your favor.

3. Establish Clear Dispute Resolution Processes

One of the leading causes of delayed payments is unresolved disputes. Setting up a clear, efficient dispute resolution process is essential for reducing DSO.

-

Fast Identification: Use a system to flag disputes immediately so they can be addressed before they drag on.

-

Timely Action: Implement a protocol for quickly resolving issues to prevent delays from affecting your DSO.

Best Practices for Optimizing DSO

Here are a few best practices that can help you stay on top of your DSO and continue to improve over time:

Use Automation for Everything

Whether it’s invoicing, deduction management, or dispute resolution, automation is key to reducing DSO and managing cash flow problems.

Keep Communication Open

Regular communication with Walmart and other customers can ensure that payments are never delayed due to misunderstandings or missing information.

Monitor Your Receivables

Keep track of your accounts receivable daily. The sooner you spot any overdue payments, the sooner you can take action to bring down DSO.

Review and Refine Your Processes

Constantly evaluate your accounts receivable process. Identify bottlenecks and look for new opportunities to speed up collections and reduce DSO.

How iNymbus Can Help You Improve DSO

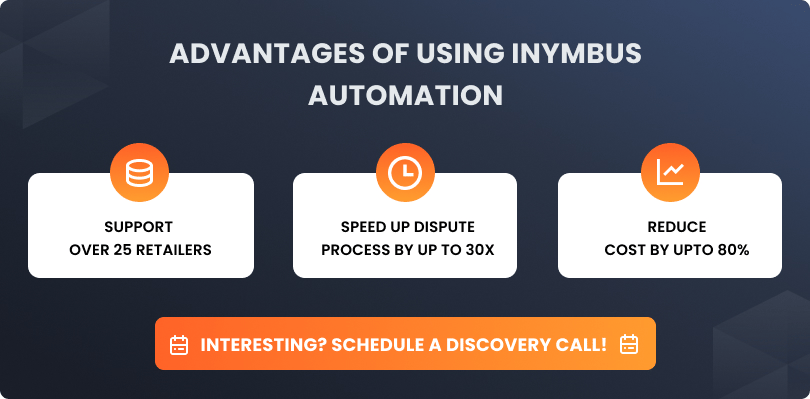

Handling deductions and disputes manually is one of the most significant bottlenecks for Walmart suppliers. But it doesn’t have to be that way. iNymbus, a deduction automation software, can help you tackle this issue head-on.

-

Quick resolution: Automatically identify and resolve deductions, speeding up the process and getting payments back on track faster. It will improve the financial health.

-

Real-Time tracking: Monitor all deductions and disputes in real time, so you're always in the loop and can take action immediately.

By automating this aspect of your accounts receivable process, you minimize manual intervention, reduce the time spent resolving disputes, and ultimately lower your DSO.

Discover the 10 best chargeback management software solutions—check them out now! 🚀 See how iNymbus automates chargeback disputes effortlessly—boost your recovery today!

.jpg)