In the intricate world of supplier-vendor relationships, navigating deductions is an inevitable aspect of conducting business. Walgreens, a prominent player in the retail landscape, issues deductions to its suppliers and vendors.

This blog aims to shed light on the challenges faced by suppliers in disputing Walgreens deductions, exploring the distinctive characteristics of the process, and proposing a solution to streamline dispute resolution.

How is disputing Walgreens Deductions different than other retailers?

Many retailers offer a platform for dispute resolution, which can help streamline the process of resolving issues with suppliers. However, Walgreens takes a different approach. Instead of providing a platform for dispute resolution, Walgreens requires suppliers to resort to the more traditional method of email. This manual process can add an extra layer of complexity to the already intricate task of disputing deductions.

Suppliers may face challenges in keeping track of email communications, and the lack of a centralized system can make it difficult to ensure that all parties are on the same page. Nonetheless, suppliers who do business with Walgreens must adapt to this approach and find ways to effectively communicate and resolve disputes via email.

Navigating Walgreens SupplierNet To Review Deductions

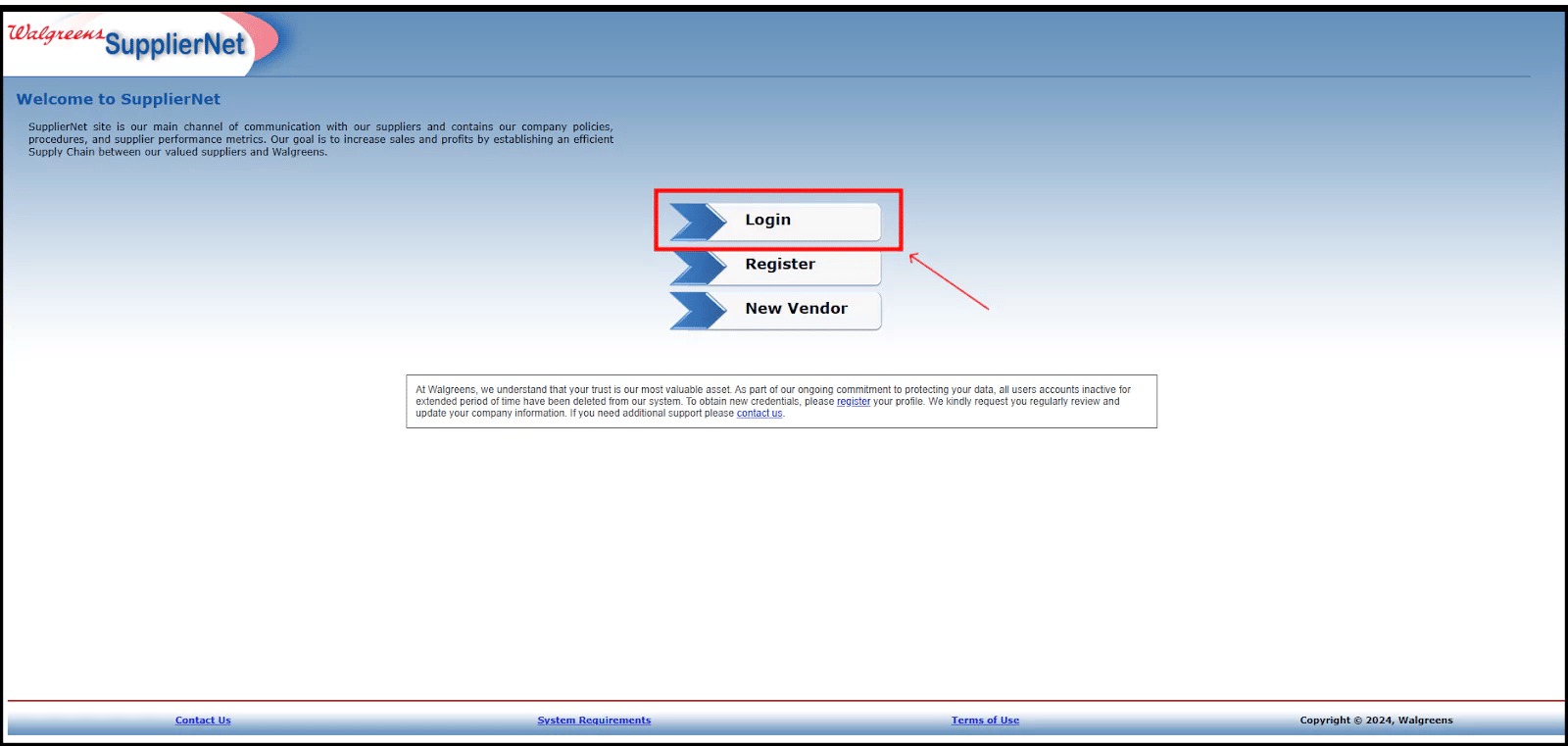

To access Walgreens SupplierNet and review deductions, follow these steps:

1) Visit Walgreens SupplierNet and sign in using your credentials.

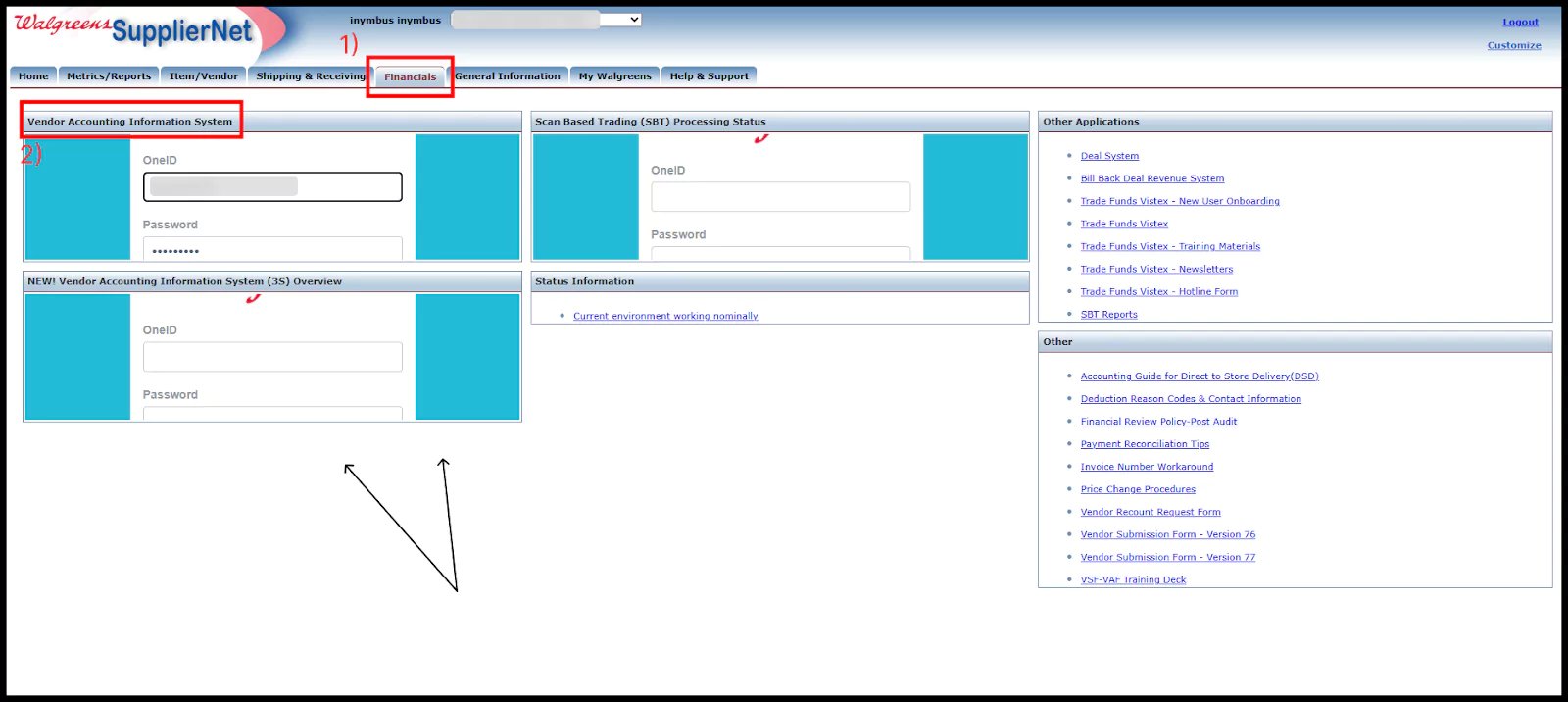

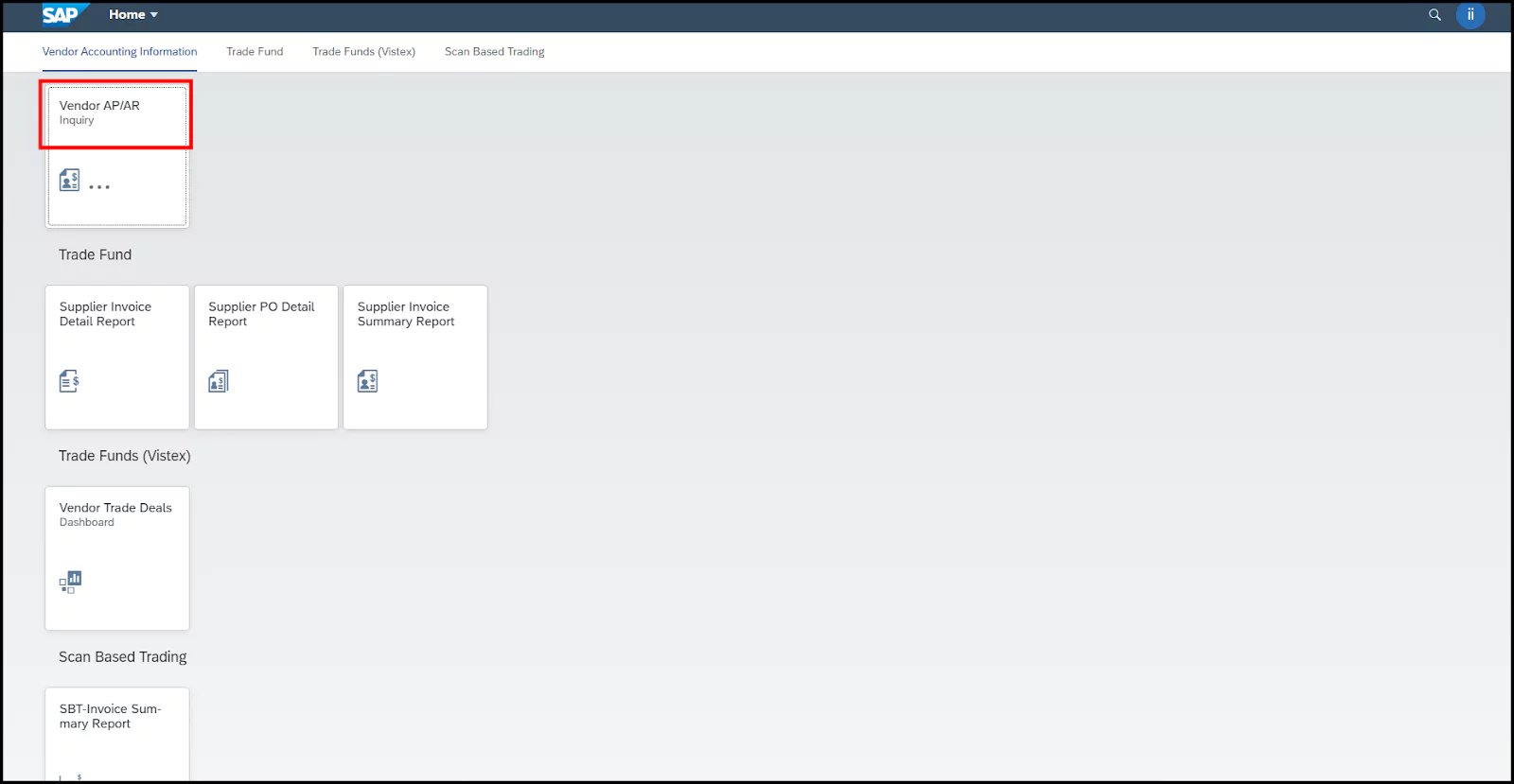

2) Navigate to 'Financials' and access the 'Vendor Accounting Information System.'

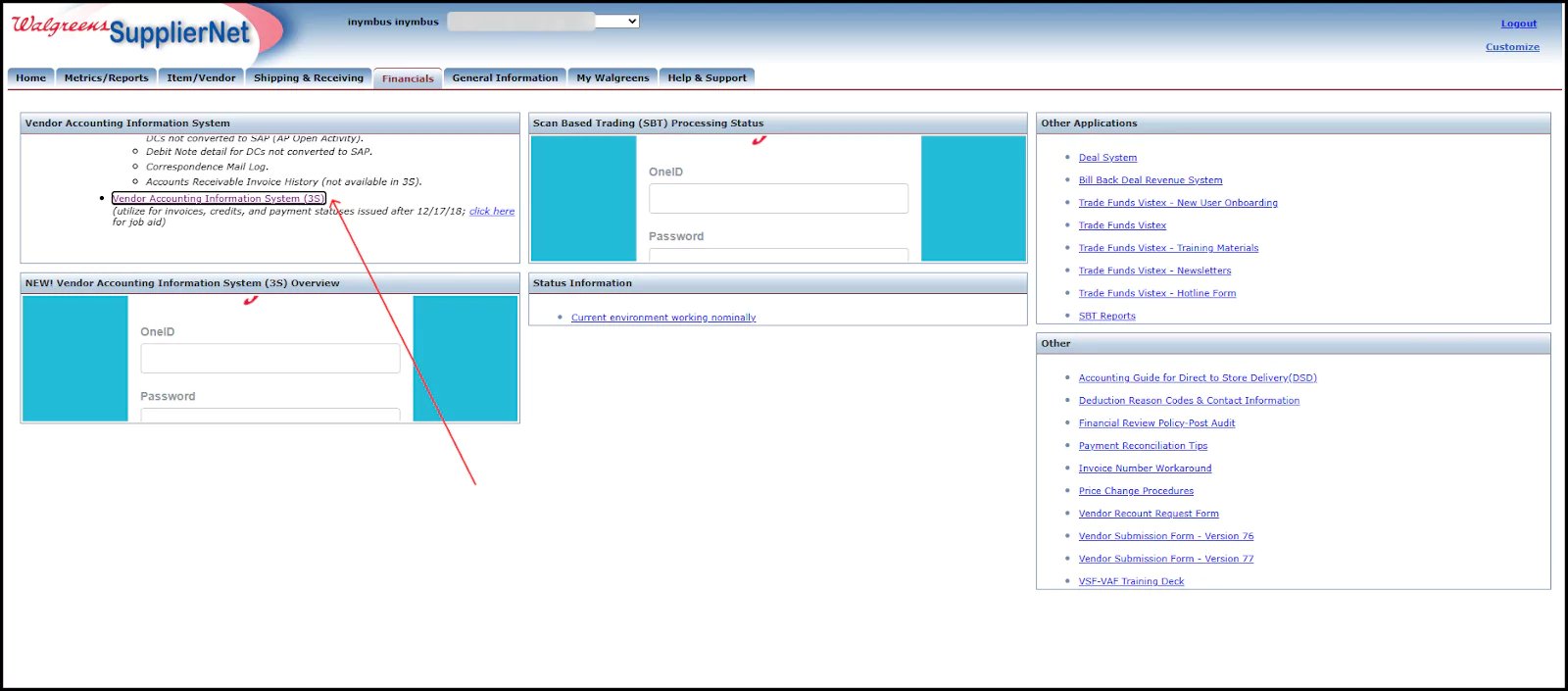

3) Within the system, click on 'Vendor Accounting Information System (3S).'

4) Proceed to 'Vendor AP/AR' to view all invoices.

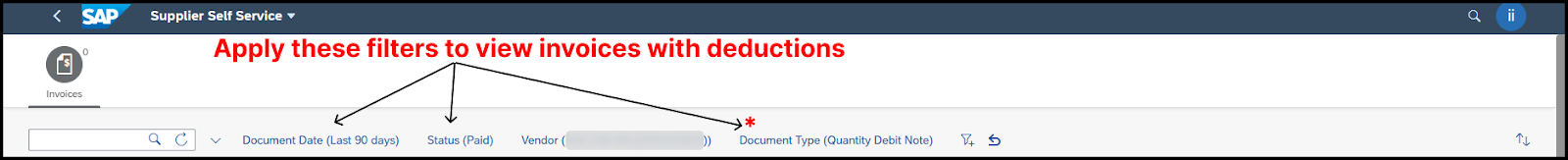

5) Apply specific filters to identify invoices with deductions.

Choose 'Paid' for Status and 'Quantity Debit Note' for Document Type to filter the relevant invoices.

Challenges in dispute resolution with email disputers like Walgreens

- Curating Emails for Disputing Deductions:

Disputing deductions via email demands meticulous attention to detail. Suppliers need to manually compile the necessary information for each deduction, slowing down the process and making it more tedious.

- Tracking – The Biggest Challenge:

The absence of a centralized platform means suppliers must rely on checking emails to know the status of their disputes. This lack of real-time tracking adds uncertainty and delays to the resolution process.

- Attaching Documents:

To substantiate their disputes, suppliers must manually retrieve documents from various portals or EDI and attach proof of documentation for each email. This not only consumes valuable time but also increases the risk of errors in the submission process.

How automation can tackle this problem

In the midst of these challenges, a viable solution emerges iNymbus’s deduction management software, designed to automate the entire process from start to finish. iNymbus efficiently addresses each of the challenges previously discussed, offering distinct advantages in deduction management.

- Efficient Data Compilation:

iNymbus's software automates the tedious task of curating information required for disputing each deduction.

- Automated Email Curation:

iNymbus, guided by Standard Operating Procedures (SOPs), can curate emails seamlessly. Vital information such as invoice numbers and claim numbers is automatically fetched.

- Real-Time Tracking:

Managing individual emails can be overwhelming, especially when faced with thousands of deductions each month. iNymbus alleviates the burden by providing a centralized platform for real-time tracking of dispute statuses, eliminating the need for manual intervention.

- Automated Document Attachment:

Bid farewell to the manual document attachment with iNymbus. The software seamlessly integrates document verification, ensuring that all necessary proofs are attached.

With a track record of over 100 satisfied customers, iNymbus has demonstrated its ability to recover millions of dollars in lost revenue for suppliers and vendors.

Explore our recent case study featuring a client with products spanning various industries, including Luxury Beauty, Health and Wellness, and Home and Outdoor, boasting an annual revenue of $2 billion. Witness how iNymbus enabled them to effectively tackle Amazon deductions and Walmart Chargebacks and optimize their financial outcomes.

Conclusion

Dealing with Walgreens deductions might seem tricky, but with tools like iNymbus-Deduction Management Software, suppliers can make things simpler. In a world that's always changing, using technology is the key to smoother business relationships. Learn to handle Walgreens deductions, and you'll be the star supplier in no time.