Many manufacturers, distributors and suppliers treat retailer deductions and chargebacks (or at least a portion of them) as the cost of doing business. However, it is possible to both prevent the likelihood of their occurrences, as well as streamline and automate the process of resolving them.

Attain Consulting Group is a deduction management advisory firm dedicated to helping companies improve profitability by reducing and controlling chargebacks and deductions. Founded by Jessica Butler, Attain Consulting prides itself in providing clients with practical, experience-based solutions to address their deduction management and compliance challenges to help companies “Take Control of Deductions.” In their latest Deduction Survey, data from over 200 companies was gathered to help guide evaluation of your own company's deduction management processes.

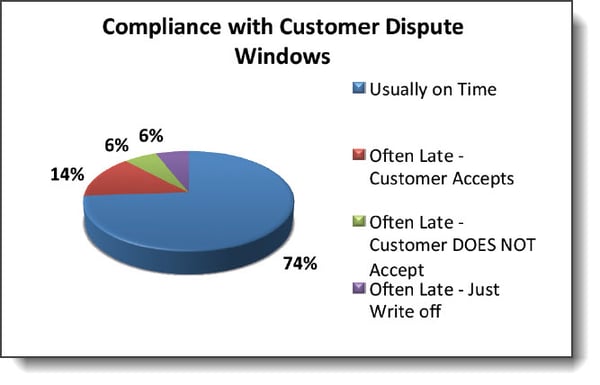

A new question added to the survey that was particularly interesting asked companies how well they are able to comply with the mandated timeframes for their customers "dispute window." 26% reported that despite efforts to prioritize, they are often outside of the customers' dispute window, and nearly half of that group either the customer does not accept or companies simply write it off.

Chart Source: Attain Consulting Group

Chart Source: Attain Consulting Group

More amazing, across all respondents, non trade-related deductions represent 1/4 to 1/2% of sales!

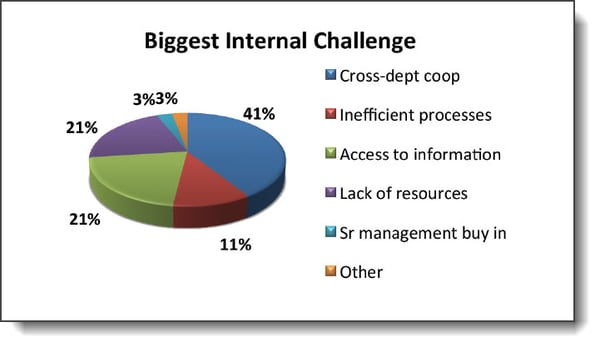

Attain found that the biggest challenges in processing deductions and chargebacks are internal challenges. Deductions are, frankly, a company-wide issue.

Chart Source: Attain Consulting Group

Chart Source: Attain Consulting Group

There are two main tactics that help take the frustration and sting out of chargebacks and deductions:

1. Prevent them from happening in the first place

2. when they do occur, clear them up as quickly as possible.

Attain asked respondents to share their strategies for preventing and resolving deductions so that others may consider this in their own improvement efforts. The top actions reported by all respondents are illustrated below:

Retailer Deduction and Chargeback Prevention Steps

- Improved order accuracy

- Made Sales / other departments accountable

- Involved other departments in customer on-boarding and/or deal/promotion

- Better communicated policies to customers

- Performed root-cause analysis

- Improved cross-functional teams

Retailer Deduction and Chargeback Resolution Steps

- Focused on timely review and follow up

- Made Sales / other departments accountable

- Improved cross-functional teams

- Better communicated policies to customers

- Improved deduction reporting

A company’s internal communication and cooperation between departments are instrumental in the prevention and resolution of chargebacks and deductions. When Attain asked companies their biggest internal challenge when trying to control deductions, 41% of respondents reported "cross-departmental cooperation." "Lack of resources" and "access to information" followed as the second most popular answers, both receiving 21% of responses.

Attain found that companies surveyed frequently stated their existing ERP systems and/or A/R packages do not provide the functionality necessary to effectively manage deductions. Whether it is the ability to track the status of a deduction throughout the process, edit reason codes, or automatically pull customer claim information or signed PODs from portals, Attain found the traditional systems of many companies fall short.

An excellent starting point in assessing your company’s current deduction performance is to review Attain’s survey results.

The survey includes statistics on deduction metrics, internal processes, best practices, and more. It's a fantastic source to benchmark information on your chargebacks and deductions. For a full copy of the detailed survey, simply request it HERE.

Implementing a 3rd party technology solution such as iNymbus can automate the manual activities associated with deduction management, by disputing and resolving chargebacks and deductions for you. In one example, appliance giant Whirlpool Corporation saved an estimated 75% of processing time for each shortage claim!

.jpg)