For many suppliers and CPG companies, chasing payments, resolving deductions, and juggling spreadsheets is a constant uphill battle. But it must not be this way. In today’s fast-paced world of retail and distribution, managing receivables well isn’t just nice to have; it’s essential to keeping cash flowing and your business running smoothly.

This guide will help you understand the core of Receivable Performance Management (RPM), unpack common challenges, and explore smarter, faster ways to turn receivables from a stress point into a strategic asset.

What is Receivables Performance Management?

At its core, Receivable Performance Management refers to how effectively your company collects the money it's owed. It covers everything from how quickly you send invoices to how well you handle deductions and disputes.

Think of it as the health checkup for your cash flow, tracking Key Performance Indicators (KPIs) that show how strong (or weak) your receivables process is. Here are five key metrics that matter most:

1. Days Sales Outstanding (DSO)

What it is:

DSO tells you how many days, on average, it takes to collect payment after a sale.

Days Sales Outstanding (DSO) Formula

Why it matters:

If your DSO is high, you're waiting too long to get paid, which can strain your cash flow. A low DSO means your collections process is working well.

How to get better:

- Send invoices promptly and accurately

- Offer discounts for early payments

- Use automation to remind customers and follow up

2. Days Deduction Outstanding (DDO)

What it is:

This tracks how long deduction claims, like shortages or compliance issues, remain unresolved.

Days Deduction Outstanding (DDO) Formula

Why it matters:

Unresolved deductions tie up revenue, and some retailers have tight windows to dispute claims. If you miss the deadline, that money is gone.

How to get better:

- Automate your deduction dispute process

- Centralized claim tracking across teams

- Focus on the biggest, most reclaims first

3. Dispute Recovery Rate

What it is:

This measures the percentage of deduction dollars you successfully recover.

Dispute Recovery Rate Formula

Why it matters:

A high recovery rate means you’re recapturing lost revenue. A low rate often points to gaps in documentation or slow dispute handling.

How to get better:

- Strengthen your documentation (POs, shipping records, ASNs)

- Automate filing with the right backup

- Analyze why deductions happen and prevent repeats

4. Percentage of On-Time Payments

What it is:

This shows how many of your customers pay their invoices on time.

Percentage of On-Time Payments Formula

Why it matters:

Good on-time payment rates mean stable cash flow. If your rate drops, it might be time to revisit your credit terms or how clearly you’re communicating them.

How to get better:

- Provide early payment incentives

- Send clear reminders

- Keep an eye on customer behavior and payment trends

5. Average Dispute Resolution Time

What it is:

This tracks how long it takes, on average, to fully resolve a dispute, from discovery to resolution.

Average Dispute Resolution Time Formula

Why it matters:

Long resolution times slow down your cash flow and eat up resources. The faster you can resolve, the quicker you can move on and collect your money.

How to get better:

- Automate wherever possible

- Standardize your workflows

- Prioritize high-value or high-frequency claims

Effective RPM ensures healthier cash flow, fewer write-offs, and more accurate forecasting.

Strategies to Improve Receivable Performance

Want to boost your receivable performance? Here are some tried-and-true strategies:

- Invoice Accuracy & Speed: Get invoices out fast, and make sure they’re complete and retailer-compliant

- Clear Credit Policies: Set fair but firm payment terms, and stick to them

- Proactive Communication: Don’t wait to follow up. Reach out early on overdue invoices

- Deduction Management: Create a structured system for reviewing and disputing deductions

- Cash Application Automation: Use tools that match payments to invoices without the manual grunt work

Common Challenges in Receivable Management

Even with the best intentions, many companies run into the same roadblocks:

- Too Many Deductions: Retailers like Amazon and Walmart generate tons of deductions, many of them invalid.

- Manual Workflows: Spreadsheets and emails can no longer keep up.

- Delayed Disputes: Missed windows for dispute resolution often mean lost revenue.

- Team Silos: When A/R, sales, and logistics don’t share data, it’s hard to get to the root of recurring issues.

- Lack of Data Visibility: Without centralized dashboards, it's tough to track KPIs like DSO, DDO, or dispute recovery.

The Role of Technology

Luckily, tech is here to help—and not just in a flashy, buzzwordy way. Real tools are solving real problems. Here’s how:

- RPA (Robotic Process Automation): Handles repetitive tasks like downloading deduction documents or submitting claims

- Dashboards & Analytics: Help you see trends, track KPIs, and make smarter decisions

- ERP & A/R Integrations: Sync your systems so finance and ops are on the same page

- AI Assistants (in some platforms): Spot errors, match documents, or even predict dispute outcomes

Technology takes you from reactive to strategic, allowing your team to focus on value, not busywork.

How iNymbus Helps You Improve Receivable Performance

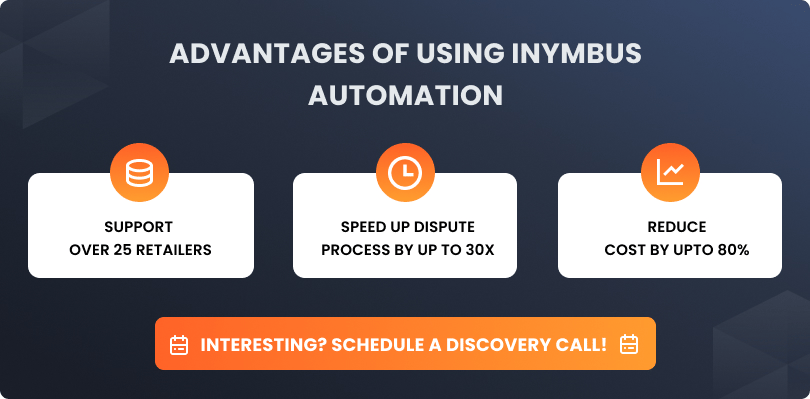

Managing receivables must not be stressful. iNymbus makes it easier by automating the time-consuming parts of the deduction and dispute process. Whether you're dealing with Amazon shortages or Walmart chargebacks, our platform connects directly with your systems and retailer portals to keep everything running smoothly.

Here’s how iNymbus supports better receivable performance:

- Faster claim processing—up to 30x quicker, so you resolve issues before they pile up

- Automatic dispute filing with all the right documents included, saving hours of manual work

- Clears backlogs fast, turning months of claims into just days of processing

- Cuts costs dramatically, with up to 90% savings per claim

- Improves key metrics like DDO and DSO, giving you more control over your cash flow

With iNymbus, your team can focus on strategy and growth, not chasing paperwork or fighting retailer portals. We help you stay ahead of deductions and get paid faster, with less stress.

Conclusion

Managing receivables doesn’t have to feel like firefighting. With the right mix of process, strategy, and automation, you can take control of your cash flow, recover more revenue, and stop letting deductions slow you down.

Suppose deduction backlogs, manual processes, or slow recovery rates are hurting your business. In that case, it might be time to rethink your receivable performance approach, and let iNymbus help you turn things around.