Deduction management is an essential part of any successful financial strategy. However, many businesses struggle with ineffective deduction management, which not only wastes valuable time but also leads to hidden costs and missed opportunities.

For example, a large book distributor found that Amazon was charging back nearly a third of their submitted invoices, resulting in thousands of chargebacks every month and significant losses.

In the retail space, where every cent counts and margins are often razor-thin, many suppliers simply allow big box retailers to take massive retail deductions. When overwhelmed by a large volume and the complexity of the process, it's easy to let deductions go uncontested.

This is where Key Performance Indicators (KPIs) come in. KPIs give businesses a way to measure, monitor, and optimize their deduction management process. By focusing on the right metrics, companies can track performance, identify bottlenecks, and set clear goals to improve financial health.

KPIs allow businesses to move beyond simply reacting to deduction issues. Instead, they can anticipate problems and prevent future deductions. After all, if you can't measure it, you can't improve it. Let’s start with an overview of the deduction management process.

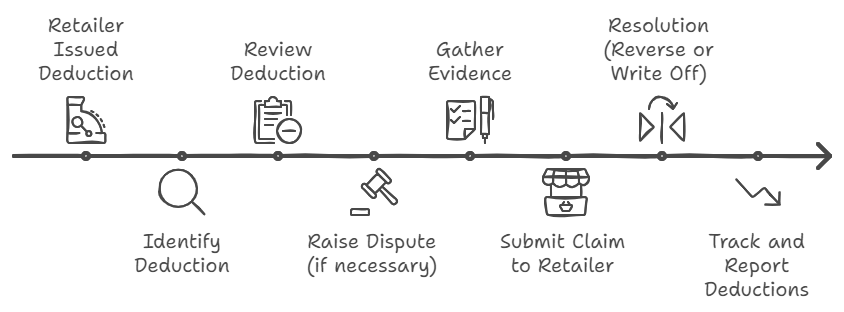

Understanding the Deduction Management Process

Deduction management is a multi-step process that begins with identifying a deduction issued by a retailer and ends with the resolution of that deduction. Let’s break down the typical workflow:

-

Identification of Deductions: The process starts when a retailer issues a deduction, often due to factors such as shipping errors, incorrect pricing, or non-compliance with retailer requirements. Businesses need a reliable system in place to detect and log these deductions immediately. A robust alert system ensures that deductions are addressed promptly.

-

Dispute Handling: Once identified, the deduction is reviewed to determine whether it is a valid or invalid deduction and if a dispute should be raised. This involves validating disputes, gathering supporting documentation, and submitting claims or proofs to the retailer.

-

Resolution: Once all evidence has been reviewed, the retailer may either agree to reverse the deduction, or the business may write off the amount if it cannot be recovered.

-

Tracking and Reporting: Throughout the process, businesses must monitor the status of each deduction, generate reports, and use KPIs to measure performance. This tracking is critical to understanding the overall impact of deductions on the company’s bottom line and cash flow.

Why Measuring Deduction Management KPI Matters

Measuring KPIs in deduction management isn't just about keeping score. It helps businesses gain insights, improve processes, and foster more accountability. Here are key reasons why deduction management KPIs are so crucial:

-

Improved Visibility: There is often near-zero visibility from the vendor side when retailers are equipped with the ruthless ability to apply deductions. Tracking and monitoring means tracking the progression of deductions, pinpointing the reasons behind them, and determining the time required for their resolution.

This allows effective categorization and prioritization of deductions based on factors such as value and due dates. -

Root Cause Analysis through Data-Driven Insights: Analyzing historical deduction data allows organizations to identify underlying trends and root causes of deductions. By mapping out the entire workflow, vendors can pinpoint areas that require improvements.

This analysis aids in identifying the bottlenecks and inefficiencies such as improving compliance or refining shipping processes—thereby reducing the frequency of future deductions. -

Strategic Performance Evaluation: KPIs allow businesses to assess the effectiveness of their deduction management processes critically. By evaluating performance regularly, companies can highlight strengths and weaknesses, enabling targeted improvements.

This includes assessing both the speed and success of dispute resolution, and ensuring that financial recovery is maximized while minimizing time and resource expenditures. -

Informed Decision-Making: Accurate tracking of KPIs means management can base decisions on concrete data rather than assumptions. Having a detailed breakdown of deduction types, root causes, volumes, and resolution times enables leaders to implement more effective strategies.

For example, if a certain retailer frequently issues shipping-related deductions, the business can target those specific processes for improvement, preventing future disputes and improving relationships with that retailer.

Essential KPIs for Effective Deduction Management

To get the most out of your deduction management strategy, tracking the right KPIs is crucial. Here are some of the most valuable KPIs to monitor:

-

Resolution Rate:

Definition: This measures the percentage of deductions successfully resolved in favor of the business.

Why it matters: A high-resolution rate shows that your team is effectively disputing and resolving deductions.

Best Practices: Standardize supporting documents (e.g., proof of delivery, pricing contracts) that are required for the most common deduction disputes. This reduces the time spent gathering documents during the dispute.

Some retailers have specific deduction policies. Create retailer-specific playbooks that outline their dispute processes and documentation requirements to improve your resolution rate.

-

Total Deductions by Type:

Definition: This tracks the breakdown of deductions by category, such as shipping errors, pricing issues, and compliance failures.

Why it matters: Understanding the most common deduction types allows you to target root causes.

Best Practices: Go beyond broad categories. For example, break down “shipping errors” into subcategories like "late shipment," "incorrect item," or "damage in transit." This allows for more targeted interventions.

Use your ERP system to flag high-frequency or high-value deduction categories early so you can investigate causes and act before they escalate.

-

Deduction Aging:

Definition: Tracks the length of time deductions remain unresolved.

Why it matters: It helps prioritize older deductions and signals where bottlenecks occur in the resolution process.

Best Practices: Set alerts for high-value deductions that exceed a specific age (e.g., 60 days). These deductions should be prioritized for review and possible escalation.

-

Day Deductions Outstanding (DDO):

Definition: Measures the average number of days it takes to resolve a deduction.

Why it matters: A Lower DDO indicates the effectiveness with which how well businesses resolve deductions.

Best Practices: Set up deduction aging buckets (e.g., 0–30 days, 31–60 days, 61–90 days). Focus daily efforts on resolving deductions in the 31–60 and 61–90-day buckets to avoid older deductions getting written off.

-

Average Deduction Amount:

Definition: Calculates the average monetary value of deductions over time.

Why it matters: This helps assess the financial impact and prioritize high-value deductions.

Best Practices: Automatically prioritize deductions above a certain dollar threshold (e.g., top 10% of deductions) for immediate handling to prevent major cash flow disruptions. Some high-value deductions may be seasonal (e.g., holidays, back-to-school). Carefully review contracts and operational processes ahead of these seasons to minimize issues.

-

Dispute Success Rate:

Definition: Measures the percentage of disputes won by the business.

Why it matters:A high success rate indicates efficient dispute resolution

Best Practices: Create a central, organized repository for all supporting documentation (e.g., contracts, shipment tracking, compliance logs). Ensure all dispute handlers have instant access to these documents, speeding up submissions and increasing success chances.

-

Cost per Deduction Resolved:

Definition: Measures the average cost (in terms of labor, time, and resources) to resolve a deduction.

Why it matters: Reducing the cost of resolution improves profitability.

Best Practices: For small-value deductions, use automation to minimize manual handling. If the cost of resolving is higher than the deduction itself, automate write-offs within certain predefined thresholds.

-

Average Time to Resolve Disputes:

Definition: Tracks the average time taken to resolve disputes, from identification to final resolution.

Why it matters: Faster resolution boosts cash flow and operational efficiency.

Best Practices: Use time-tracking tools to identify where disputes are getting delayed (e.g., documentation gathering, and retailer response). Use this data to implement focused improvements, such as better retailer communication channels or internal process tweaks.

-

Write-off Percentage:

Definition: The percentage of deductions that are written off as unrecoverable.

Why it matters: A high write-off percentage indicates lost revenue due to process inefficiencies.

Best Practices: Establish a threshold for automatic write-offs (e.g., <$30). This reduces time spent on low-value disputes that cost more to resolve than they are worth.

Automation-Driven Deduction Management with iNymbus

iNymbus is designed to significantly improve your performance across key deduction management by automating time-consuming and error-prone processes. By leveraging Robotic Process Automation (RPA), iNymbus optimizes each step of the deduction workflow, helping businesses achieve better results with less manual effort.

-

Faster Dispute Resolution: iNymbus automates dispute submissions and retrieves necessary documents, resolving deductions much quicker than traditional methods.

-

Improved Success Rate: Automation ensures the right documentation is attached to disputes, meeting specific retailer requirements and minimizing rejections.

-

Centralized Management: iNymbus provides a centralized hub for tracking and analyzing deductions across multiple retailers, making it easier to identify issues and optimize strategies.

-

Lower Operational Costs: By automating manual processes, iNymbus reduces the cost per deduction resolved, boosting operational efficiency and allowing your team to focus on higher-value tasks.

In short, iNymbus enables businesses to streamline deduction management, making it easier to track, improve, and excel while reducing costs and improving cash flow.

.jpg)