As a business, it’s always great to get that check from your retailers at the end of the month. But you know what’s not so great? Noticing a huge chunk of money missing, with some mystery reason codes that look like Greek. What’s up with all these deductions? And what can you, as a retail supplier, do about it?

As a business, it’s always great to get that check from your retailers at the end of the month. But you know what’s not so great? Noticing a huge chunk of money missing, with some mystery reason codes that look like Greek. What’s up with all these deductions? And what can you, as a retail supplier, do about it?

Deductions have become a natural occurrence for retail suppliers, especially for businesses selling their goods to big-name retailers like Walmart and Amazon. While deductions are regularly taken by retailers, they should never simply be accepted without investigation.

We explore everything you need to know about deductions and how to streamline this necessary process. let's start with what is deduction management in accounts receivable.

What is Deduction Management?

Deduction management refers to the systematic approach businesses use to identify, track, and resolve underpayments on invoices. These underpayments, known as deductions, can arise for various reasons, such as damaged goods upon receipt, missing items from an order, or compliance issues by the supplier.

Effective deduction management involves closely monitoring issued and settled invoices, understanding the root causes of deductions, and identifying patterns. By proactively managing deductions, businesses can minimize revenue loss, improve cash flow, and enhance relationships with trading partners.

Implementing deduction management best practices is key to reducing their impact on your bottom line. The "Bottom Line" refers to a company's net income or profit after all expenses have been deducted from total revenue. Reducing the impact of deductions helps protect the bottom line and maintain positive cash flow.

Strong cash flow is essential for the success of any business. One key way to ensure healthy cash flow is through effective deduction management. Deductions can have a significant impact on a company's bottom line. It's crucial to have a well-structured process in place to handle them.

For More Info Check Our Blog On Common Reasons for Chargebacks In Retail

How Does the Deduction Management Process Work?

A well-structured deduction management process is essential for tracking, analyzing, and addressing deductions. The specifics of your deduction management process will depend on factors such as:

- Your Retail Partners and Vendor Portals

- Internal resources and manpower

- Your Software capabilities

The process of deduction is usually incredibly time consuming and includes multiple steps. Many suppliers are simply overwhelmed and allow big box retailers to take massive retail deductions.

If your process isn't efficient for managing them, it can seem like a waste of time (and therefore money) to follow up on each one. This can lead to hundreds of thousands, if not millions, of dollars getting stuck or written off each year.

The key is to make the process of deduction as efficient as possible in a way that suits your operation. With good efficiency, you can improve your recovery rate on deductions and make sure your invoices are paid in full. You can also decrease the amount of time and manpower that focuses on resolving deduction disputes.

A manual or traditional deduction process in accounts receivable will usually follow this flow:

- Deduction Alert

The most important step in the entire process is seeing the deduction. A good system will allow you to see it before the deduction even reaches the Accounts Receivable phase. Proactively disputing deductions prior to payment is key. - Prioritizing Importance

Not all deductions are of the same importance. Some may just be for a few cents usually due to human error when typing in the number. Others can be for large sums of money. The higher the deduction amount, the more urgent it is to resolve the issue. - Research

The next step is to gather information about why or how the deduction happened. The original invoice is the first source of data as it has the details and information about the sale, as well as the reason code for why the deduction occurred. However, there are plenty of other supporting documents that need to be collected and organized.

- Deduction Document

- Purchase Order

- Bill of Lading and

- Proof of Delivery

- Other Supporting Documents

- Determining Validity

With all the relevant data in front of them, the person or software working on the deduction can make a call on whether or not the client had a valid reason to make the deduction. If there is something wrong with the order quantities or the quality of the product, the client will have a valid claim for short-paying. In the case of an error in payment, the deduction is not considered valid. - Submit a Dispute

The next step is to dispute the claim on the appropriate vendor portal, where you as a business upload claims and any backup documentation. It’s necessary to create an individual supporting document for each of the charges separately.

Amazon Vendor Central is one of the most widely used customer portals, yet disputing claims on the interface is a laborious task. All documents related to the claim need to be uploaded manually. Additionally, all information must be entered into the portal, followed by any necessary manual correspondence.

A dispute management process generally goes through stages that include Under Review, Need More Information, Approved, Approved and Paid, and Denied. If a dispute is denied, you can dispute the deduction again, and provide additional evidence. If the dispute is approved, the deducted amount should be credited to your account.

Deduction Reporting

This is a key function of any deduction management process. The reports show how many deductions were made in a time period, who they were made by, and how they were resolved valid or invalid. Using this information, you can spot any problem areas or regular deduction makers.

The data can help you to make better delivery or invoicing choices in the future. Additionally, it will increase your chances of receiving the full sum owed, when it’s due.

Should You Go Manual Or Automated?

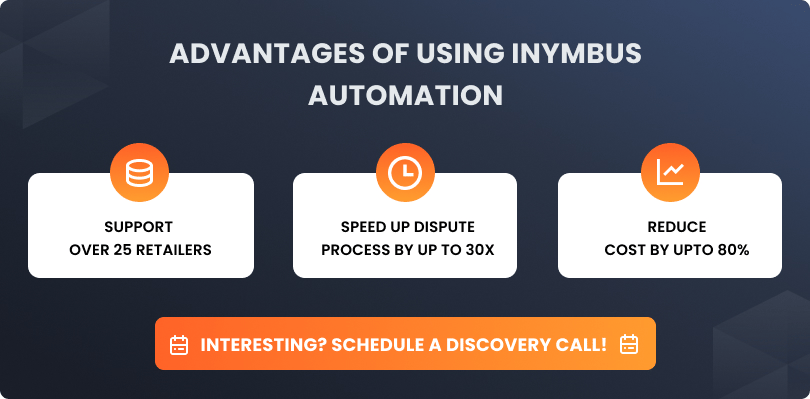

It's a no-brainer to leverage automation in deductions management to fully automate your deductions process. With a fully automated and integrated system like iNymbus, you can take out the need for a team or individual to have to sift through the paperwork and make calls on the validity of the deduction.

Remember, deductions can have a significant impact on your cash flow and accounts receivable, so it's worth making the process of managing them as smooth and efficient as possible.

If you are dealing with a large number of deductions on a monthly basis, automating with deduction management software like iNymbus will get you through them quicker, putting more money back in your pocket.

In case, if you are wondering how to choose the best deduction management software check our blog.

.jpg)