If you’ve ever shipped to CVS, chances are you’ve dealt with shortage deductions, the dreaded notice that CVS claims fewer units arrived than what you billed them for. Painful? Definitely.

But here’s the thing: you don’t have to just swallow the loss. CVS has built-in channels, like the Vendor Deductions Management Dashboard (VDMD), where you can push back and get your money back.

This guide breaks down the exact steps, highlights the traps to avoid, and shows how automation platforms like iNymbus can make the whole process faster, cleaner, and far less of a headache.

Why CVS Shortage Deductions Matter

If you’ve worked with CVS, you know shortage deductions aren’t just annoying; they hit your bottom line. One deduction may look small, but across multiple shipments, they add up to thousands in lost revenue. And when you don’t dispute them, three things happen:

- Profit loss: Every unpaid claim chips away at your margins.

- Wasted effort: Your team keeps chasing the same problems without fixing the root cause.

- Missed deadlines: CVS enforces strict deadlines, and missing them causes you to lose money.

That’s why disputing CVS shortage deductions isn’t optional; it’s the only way to protect cash flow and keep your CVS partnership profitable.

Understanding Shortage Disputes in CVS VDMD

CVS handles all shortage disputes through its Vendor Deductions Management Dashboard (VDMD). Think of it as your control center for tracking memos, filing disputes, and uploading backup documents. A few things to keep in mind:

- Every deduction comes with a debit memo you’ll find in VDMD.

- You have 30 days from the deduction date to file your dispute.

- The system times out after 20 minutes. Save your work as you go.

- You can upload up to 10 documents per dispute, each no larger than 20MB.

Knowing these basics upfront makes the dispute process smoother and avoids preventable mistakes.

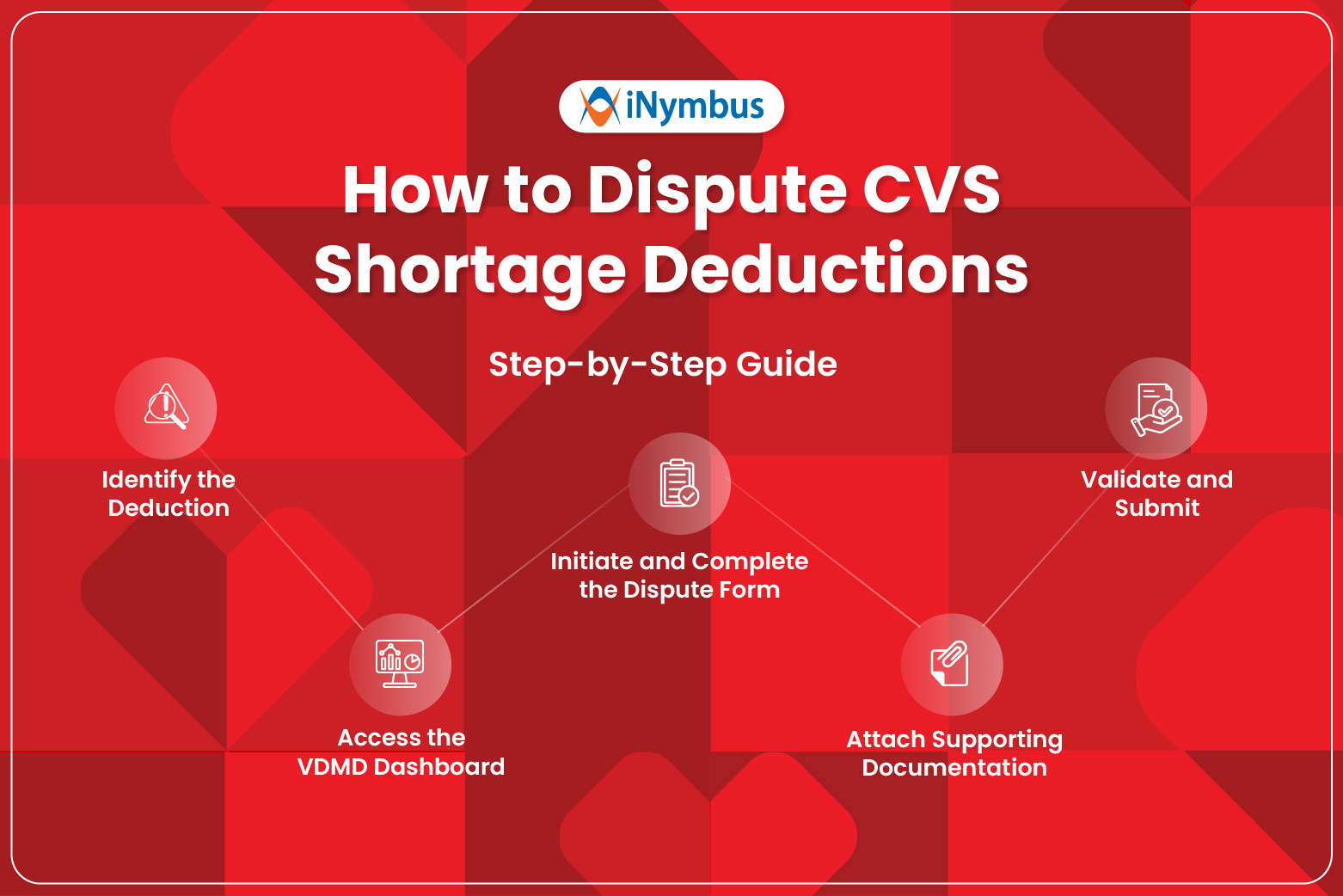

Step-by-Step: How to Dispute CVS Shortage Deductions

Step 1: Log in to the CVS Vendor Portal

Access the CVS Vendor Portal and head to the Vendor Dispute Management Dashboard (VDMD). You manage all shortage disputes in this dashboard.

|

|

Step 2: Start a New Dispute

Select Initiate Dispute and enter the required details. Make sure you choose the correct vendor number, dispute type, and subtype. Fill in the fields with the information from each debit memo.

Step 3: Upload Supporting Documents

Attach your backup documentation, Debit Memo, Proof of Delivery (POD), and Bill of Lading (BOL) are required. You can upload up to 10 files per dispute (20MB max each). Be mindful of the 20-minute auto-timeout and save as you go.

Step 4: Add Comments

Use the Message tab to include any notes that support your claim. Clear, concise comments can help CVS process the dispute faster.

Step 5: Validate and Submit

Click Validate, then change the status to Disputed. Once submitted, monitor the portal regularly for updates or responses from CVS.

The Role of Automation in CVS Deduction Recovery

Managing CVS shortage deductions manually takes a lot of time and can lead to mistakes. For suppliers handling many deductions, missed deadlines, incomplete documents, and repeated portal work can cause lost revenue.

iNymbus solves this by automating the dispute process. Here is how it helps:

- Automatic Debit Memo Retrieval: iNymbus pulls debit memos directly from the CVS Vendor Deductions Management Dashboard.

- Document Collection: The platform gathers all necessary documents, including Proof of Delivery (POD), Bills of Lading (BOL), and invoices, without manual effort.

- Dispute Submission: iNymbus completes and submits disputes with full documentation. This keeps claims compliant with CVS rules and deadlines.

- Dispute Tracking: Every dispute is monitored to make sure nothing is missed.

Supplier Results with iNymbus

Suppliers using iNymbus report major improvements:

- Fast Backlog Clearance: Thousands of disputes are resolved in weeks instead of months.

- Revenue Recovery: One supplier recovered 92% of previously lost revenue by filing every eligible claim.

- Lower Costs: Dispute processing costs dropped by 80 to 90%, freeing teams to focus on more important tasks.

- Faster Resolution: iNymbus processes claims faster, turning deduction management into a smooth, efficient workflow.

With iNymbus, suppliers protect margins, recover more revenue, and spend less time on manual work. Your team can focus on growing the business while iNymbus handles every claim.

FAQs About CVS Shortage Disputes

How long does CVS take to review disputes?

Usually, a few weeks. Keep checking VDMD for updates.

What if CVS denies my dispute?

Look at the rejection reason and resubmit with stronger documentation if possible.

Can I recover every deduction?

No. Late filings or missing paperwork usually mean no recovery.

How does automation work with VDMD?

Tools like iNymbus pull memos, gather documents, and submit disputes directly into VDMD for you.

Conclusion

CVS shortage deductions can quickly eat into revenue if ignored. Following a clear dispute process and keeping proper documentation helps suppliers recover lost funds. For high-volume operations, iNymbus files disputes accurately, meets all deadlines, and reduces manual work.