Part of running a manufacturing company involves knowing how to manage operational challenges effectively. Manufacturing CEOs are among the many business leaders predicting continued volatility in the industry. To stay competitive, you need every possible advantage.

Have you examined your deductions workflow lately? Deductions aren't just a necessary cost of doing business. According to Attain Consulting, 90% of deductions are still invalid!

Let's learn more about deductions processing and how an automated solution can benefit your business.

What is Manufacturer Chargeback?

Manufacturer chargeback refers to a reduction in the payment made by a retailer to a manufacturer or distributor. These chargebacks occur due to various reasons, including discrepancies or issues with the delivered goods or services.

Common Types of Deductions

iNymbus focuses on three deduction categories: Shortage, Compliance, and Pricing:

- Incorrect Charges: Errors in pricing or billing.

- Improper Invoicing or Delivery Notification: Issues with how invoices or delivery notices are issued.

- Packaging Errors: Problems with how products are packaged.

- Damaged Goods: Goods that are damaged upon receipt.

- Incorrect Shipping Methods: Shipments that do not adhere to agreed methods or specifications.

If your company agrees with the retailer, you have to deduct the amount from the bill or invoice and reissue it. If you disagree, you have to dispute the claim, normally through a portal.

You have to prove that a deduction isn't valid when disputing a deduction. Your employees have to research, dispute, and clear the claim.

Priorities in Deductions Processing for Manufacturers

Priorities in Deductions Processing for Manufacturers

Effective deductions processing is critical for your manufacturing business. It's important for your bottom line and cash flow. You need your deduction management to accurately resolve disputes as soon as possible.

Timely Resolution:

Disputing deductions should happen as soon as possible. The more time your employees spend researching and validating a dispute, the less time they have for other tasks. The revenue is in limbo as it awaits a decision.

Some large retailers only accept claims disputes for a certain amount of time. If you miss the deadline, you lose the revenue. Consistently disputing claims with automation is a step toward improving your recovery rates.

Prioritizing Deductions:

Not every deduction is equally important. Some may be high value, straightforward to solve or require multiple documents as proof. It’s important to prioritize unresolved disputes strategically.

Reduce Revenue Leakage:

An inefficient deduction management process means you don't collect some of the revenue your customers owe you. Even deductions that seem small individually will add up. A large volume of uncollected claims can affect your cash flow, working capital, and profitability.

Managing your deductions effectively helps you maximize your collected revenue. The automation solution you choose should process aging deductions, helping maximize your investment.

Root Cause Analysis:

Root cause analysis helps you assess your internal operations. You can see where process changes can improve your results, such as in compliance or supply chain. This way, you can take action to stop them from happening in the future, thus saving time and money.

Benefits of Automating Your Deductions Processing

Manually processing deductions can be complicated and time-consuming. After your business reaches a certain volume of deductions per month, you struggle to meet your goals.

To try to handle an increasing volume of deductions manually, you could hire more people. This increases your costs. It's only scalable up to a point.

You could outsource your deductions processing to a third-party company. This transfers the problem to someone else, but it doesn't address the real problem.

Deduction automation helps streamline the process. Automated solutions use the power of robotic process automation (RPA).

You can process claims more efficiently. You get data to help you reduce the number of incoming claims while directly maintaining control of processes and business rules.

Faster Deduction Processing:

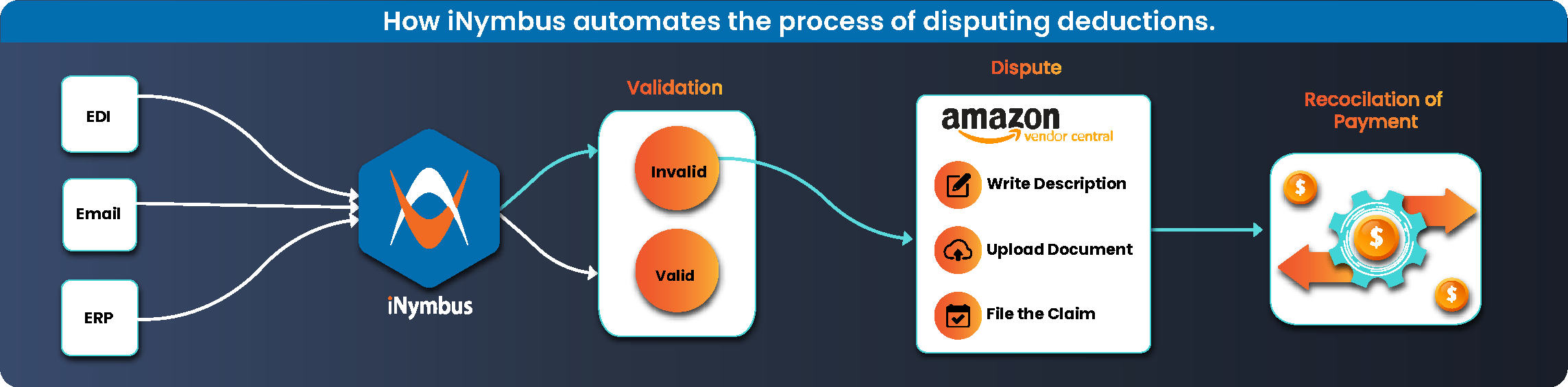

Automated deduction management significantly reduces the amount of time it takes to research and resolve deductions. iNymbus automatically extracts backup documents from carriers, EDI, and other sources. Eliminate the need to work out of multiple windows and tools by allowing bots to handle the research step.

Operational Efficiency:

Deduction automation streamlines your deduction management. You don't need to manually create tasks for employees to research and validate claims. An automation solution can validate invoice amounts and create a clear audit trail. All deduction information flowing through iNymbus is displayed on a single dashboard that we call DeductionsXchange.

Reduce Costs and Improve Revenue:

Automated deductions processing reduces the number of employees you need to work on deductions. Staff across a range of departments have more time to devote to core tasks and value-added activities.

An automated solution helps you recover more revenue, especially with the ability to re-dispute claims. You are able to maximize the amount you recover per dispute and reduce the number of write-offs.

Get Better Insight into Deductions Causes:

Our RPA solution automatically identifies the cause of deductions and disputes. It collects real time data from many sources, including emails, payments, and remittances. It uses rule-based logic with these comprehensive datasets to identify and categorize the cause of a deduction.

Learn Benefits of Automating Freight Damage Claims

How iNymbus Automates Deductions Processing

iNymbus uses cloud-based Robotic Process Automation (RPA) to identify and validate deductions and fill disputes. Our technology is designed to increase efficiency and reduce the cost of claims. We support claims from over 40+ retailers and offer a high degree of customization and flexibility.

You can process claims up to 30x faster at a fraction of the cost of traditional manual processing. You'll win on an average of 80% of claims. iNymbus has the capability to re-dispute and automate follow-up for further recovery.

Start Improving Your Deductions Processing

Automated deductions processing from iNymbus brings significant benefits to your manufacturing company. You can process claims faster, reduce costs, and minimize future deductions.

We start with a detailed assessment of your business processes. Then we can determine the best automation solutions and robot integration points.

.jpg)