If you’re a supplier working with UNFI, you may have noticed unexpected deductions and chargebacks on your invoices. You’re not alone. Just like with other major retailers, many suppliers working with UNFI have found invalid deductions, raising concerns about delayed payments and cash flow issues.

These deductions can quickly add up, eating into your profits and making it difficult to manage cash flow. The worst part? Disputing them manually is a time-consuming and frustrating process.

But there’s good news—automation can change the game. This article will break down the key issues suppliers face with UNFI deductions and show how iNymbus can help you dispute them effortlessly.

Understanding UNFI’s Deduction Practices

Before we dive into the solution, let’s look at some common scenarios suppliers face when working with UNFI. These deduction issues are reported frequently and can significantly affect supplier cash flow and profitability:

-

Numerous Invalid Chargebacks:

Suppliers often receive deductions labeled as chargebacks for "unacceptable" products, even when those products were neither returned nor flagged for any quality issues. These invalid chargebacks can be disputed easily and the revenue can be recovered. -

Early Payment Discounts Taken Late:

Another frequent issue involves UNFI taking early-payment discounts even when invoices are paid after the agreed-upon discount window. This reduces supplier revenue and can cause a reduction in the supplier's profit margin. -

Deductions Without Clear Explanations:

The lack of clarity makes it difficult to validate or dispute the deductions, forcing some suppliers to absorb the losses or spend excessive time chasing down information. The complexity of UNFI’s system forces many suppliers to either accept deductions as losses or spend valuable time fighting to get their money back.

For smaller suppliers, these deductions can be devastating. If you don’t have the resources to challenge them effectively, you may end up losing money that rightfully belongs to you.

The Challenges of Disputing UNFI Deductions

Many suppliers attempt to dispute UNFI deductions, but the process is anything but easy. Here’s why:

1. Complicated Dispute Process

UNFI’s deduction system can be difficult to navigate. Suppliers often have to provide extensive documentation and wait weeks or even months for a response.

2. Time and Labor Costs

Disputing deductions manually requires a dedicated team to review chargebacks, gather proof, and submit claims. This can be overwhelming, especially for suppliers who also deal with other retailers.

3. Fear of Retaliation

As with every other retailer, suppliers often avoid disputing deductions due to fears of reduced orders or being deprioritized.

4. Missed Recovery Opportunities

Because of the difficulty involved, many suppliers let deductions go unchallenged. Over time, this can result in substantial financial losses.

How iNymbus Automates UNFI Deduction Disputes

Instead of spending hours disputing deductions manually, suppliers can now automate the entire process with iNymbus. Here’s how it works:

Once Standard Operating Procedures (SOPs) are created for your deduction issues, iNymbus takes over the entire process—identifying, disputing, and tracking deductions with zero manual effort.

End-to-End Automation:

iNymbus follows a structured, automated approach:

- Identifies new deductions based on predefined Standard Operating Procedures (SOPs).

- Validates each deduction to determine if it should be disputed. If found invalid, the system fetches all required documents automatically.

- Organizes the complete claim package with supporting evidence.

- Submits the dispute directly on the appropriate portal for fast processing.

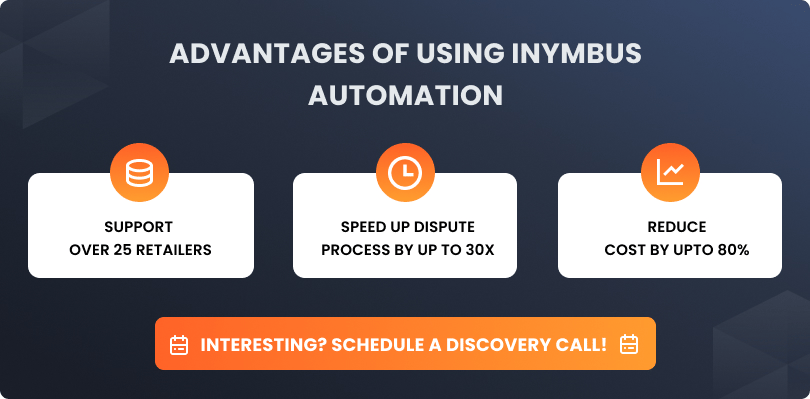

Key Benefits of iNymbus Automation:

30x Faster Dispute Resolution – Our system processes disputes significantly faster than manual methods, ensuring quick fund recovery.

Savings – Automation drastically reduces the expense of handling deduction disputes.

Scalable for All Suppliers – Whether you're a small business or a large CPG company, iNymbus can manage your UNFI deductions efficiently.

How to Get Started with iNymbus

Getting started with iNymbus is simple:

- Easy Onboarding – Our team sets everything up with minimal effort on your end.

- No Disruptions – The system works alongside your existing operations.

- Immediate ROI – As soon as the automation is in place, you’ll start seeing results in recovered deductions.

Conclusion

If you’re a UNFI supplier, deductions are likely cutting into your profits more than you realize. While disputing them manually can be frustrating and costly, automation provides a fast, efficient, and cost-effective solution.

Don’t let deductions hurt your bottom line. Book a demo today and see how iNymbus can help you recover revenue from UNFI deductions effortlessly.

.jpg)