Walmart is one of the largest retailers in the world, with millions of customers and thousands of suppliers. As a supplier, you may have experienced some deductions from your invoices due to various reasons such as price differences, shortages, damages, or returns.

These deductions can affect your cash flow and profitability, so you may want to dispute them and get your money back.

In May 2023, Walmart made significant changes to its dispute resolution process impacting the way you dispute deductions and recover revenue. With the launch of the Accounts Payable Disputes Portal (APDP), suppliers are now required to dispute deductions individually, marking the end of the Settlement Disputing method.

This article aims to explore the impact of these changes on suppliers' businesses and provide effective tips and solutions to handle the new system, ensuring an edge in the Walmart Deduction Recovery.

Understanding Walmart Settlement Disputing:

Settlement Disputing was a method employed by large suppliers dealing with thousands of shipments to Walmart which streamlined the process by settling all deductions within a specific timeframe, often quarterly.

Despite its convenience, this approach came with uncertainties leading to potential cash flow problems as payment settlements could take months.

How To Dispute Walmart Claims On APDP

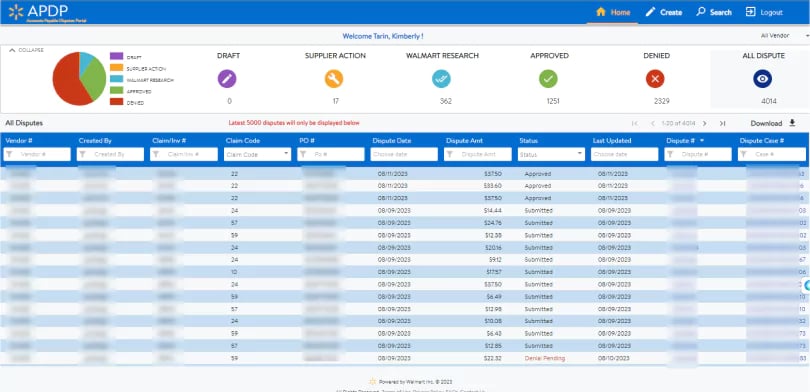

Walmart has implemented Accounts Payable Disputes Portal (APDP) as an integrated part of Retail Link. This new portal provides a more robust solution for suppliers to manage and dispute Walmart deductions more effectively and efficiently.

Key Advantages of APDP:

- Streamlined Access: APDP is seamlessly accessible through Retail Link accounts, eliminating the need for a separate login or account creation.

- Line-Level Disputes: Unlike the overall deduction level disputes in Settlement Disputing, APDP allows you to submit disputes at the claim line level rather than at the overall deduction level. For example, if you received a deduction for code 22 (goods billed not shipped) for three items on one invoice but only one item was missing, you can dispute only that item rather than the whole invoice. This gives you more flexibility and accuracy in disputing deductions.

- Improved Communication: APDP facilitates direct communication between dispute analysts and suppliers, allowing for faster resolution and providing transparency on dispute statuses and relevant messages.

Common Walmart Deduction Codes to Look out for:

Understanding the types of deductions is crucial for effective dispute resolution and revenue recovery. Here are some common types of deductions with codes to look out for:

| Shortages | Pricing | Compliance |

| Code 21 - Concealed Shortages |

Code 10 - Discrepancies in allowances between the invoice and the PO |

Code 64 - Early Shipment |

| Code 22 - Goods Billed Not Shipped | Code 11 - Cost differences between the invoice and the purchase order | Code 65 - Late Shipment |

| Code 23 - Carton Shortages | Code 31 - PO number not on the invoice |

Read a detailed article on all the popular Walmart Deduction Codes

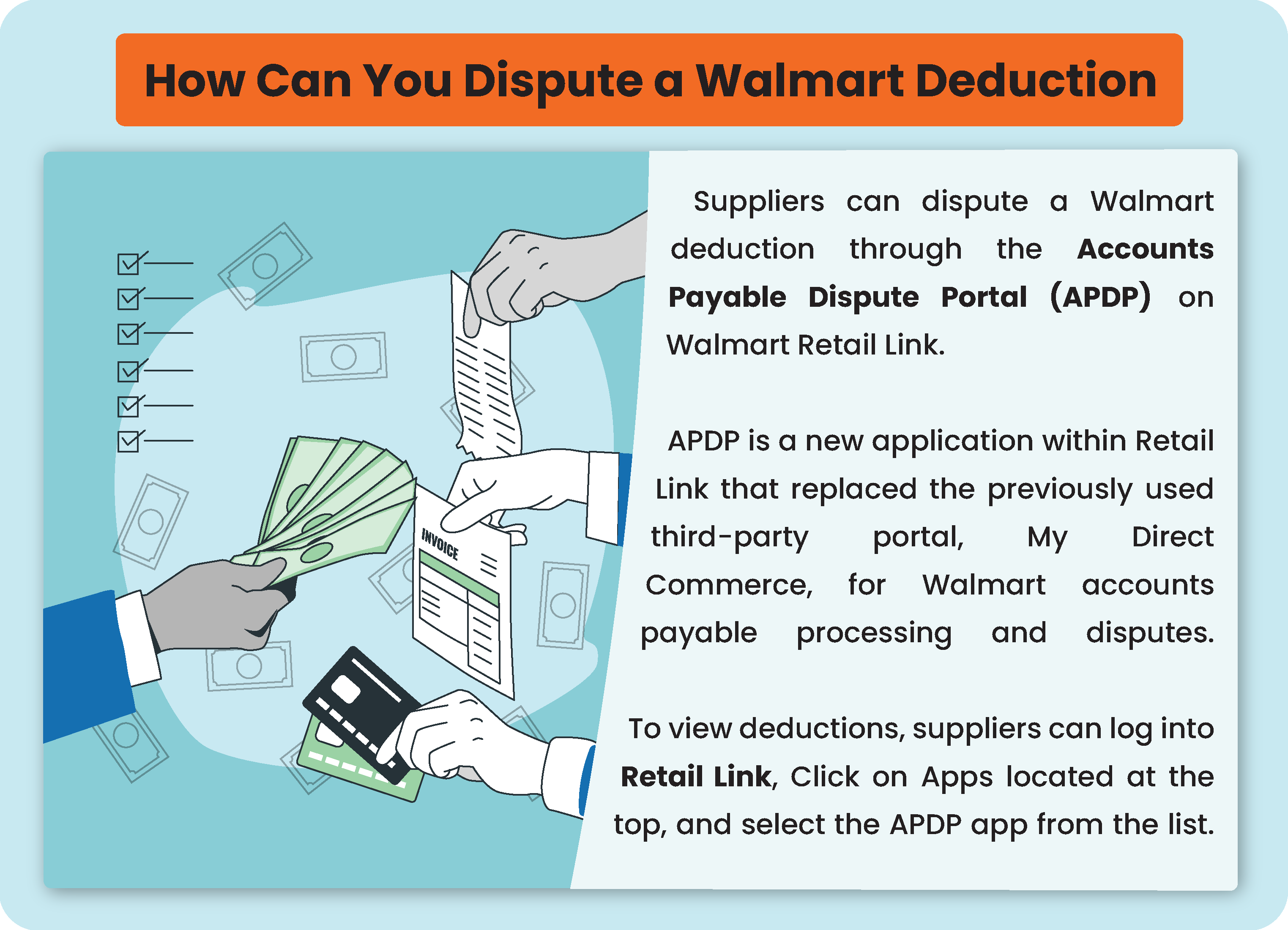

Information And Documents Required To Dispute A Walmart Deduction

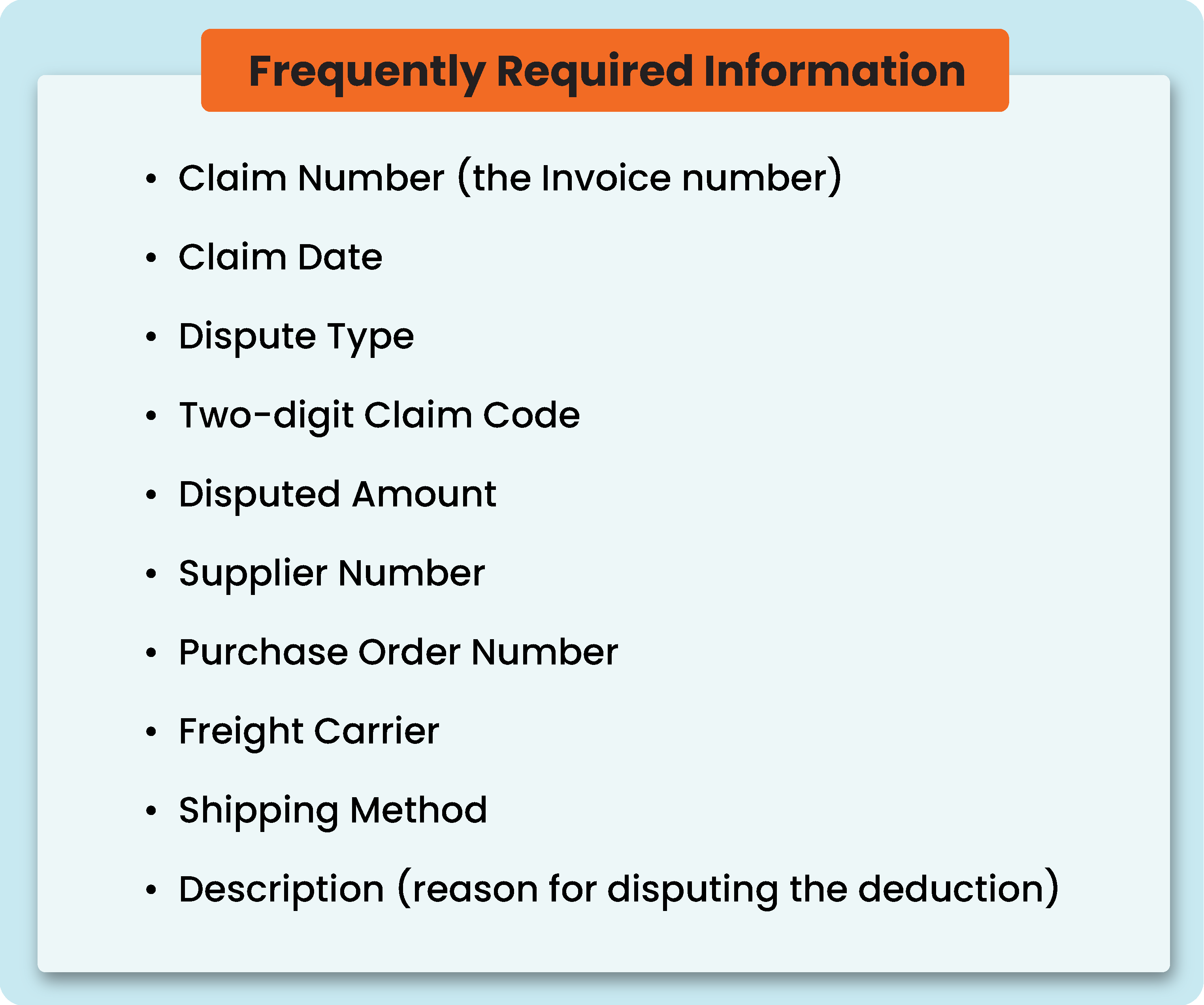

When initiating a dispute for Walmart Claims through the APDP system, the submission of specific documentation is essential. A range of information is necessary to facilitate the dispute resolution process.

While some information can be easily obtained, others may require access to various portals before they can be used on the APDP platform.

Presented below is a list of frequently demanded Information for effective dispute management:

List of Frequently Requested Documents:

- Proof Of Delivery (POD)

- Bill Of Lading (BOL)

- Electronic Data Interchange

- Invoice

- Claim #

Future Of Vendors Using Settlement Walmart Disputing

Now that Settlement Disputing has been phased out, vendors using this method will need to adjust their strategies to cope with individual deduction disputes on APDP.

The success of vendors now disputing individual Walmart deductions depends on how well they adapt to the changes that Walmart introduces and how well they can optimize their disputing process.

Some best practices that vendors can follow to improve their disputing performance are:

- Master the APDP Platform: Learn how to use Walmart's Accounts Payable Disputes Portal (APDP). It's where you can track deductions, dispute them, and find resources to understand deduction codes.

- Proper Documentation: Have all your paperwork in order, like proof of delivery, bills of lading, and invoices. This documentation helps you prove your case and sort out deductions faster.

- Walmart Deduction Codes: Get to know Walmart Deduction Codes to understand why deductions occur and be ready to dispute them effectively.

- Monitor Your Deductions: Keep an eye on deduction reports regularly to spot trends and recurring problems. Addressing these issues helps prevent future deductions.

Someone who has used APDP before knows how time-consuming and repetitive it can get to dispute every single deduction, especially when your company receives thousands of them every single month.

You Can Leverage Technology To Automate Walmart Deduction Recovery

You can leverage the Walmart deduction recovery services provided by iNymbus to automate your deduction management process. iNymbus uses Robotic Process Automation (RPA), which is specifically designed to work with retailer portals, EDI, and other document sources to create and submit disputes quickly.

Whether it is Amazon, Walmart chargeback, Lowe's, CVS, or any of the 40+ other retailers we support, iNymbus will streamline the end-to-end Walmart Deduction Management process for your staff.

Tailored precisely for your company's SOPs, our RPA solution guarantees maximum efficiency, seamlessly integrating with your existing tools and procedures. Leave the complex bot configurations to us, as we take care of all the heavy lifting. Within a few weeks, you'll have a fully operational, live product, empowering your business with enhanced productivity and streamlined processes.

These are the results our clients have got after they onboarded iNymbus deduction management software:

- 30X efficiency boost in processing chargebacks

- Cost-per-claim reduced by a drastic 80-90%

- Reduction in duplication of work and unnecessary manual steps

- Continuous disputing and follow-up of all claims

- In-app reporting showing the status of all claims across all connected retailers.

Book a quick and informative demonstration call to explore how iNymbus can help you achieve your specific objectives for deductions and disputes. We support over 40+ retailers.