As an Amazon Vendor, it's not uncommon to encounter an upsurge in deductions from Amazon, and one of the most prevalent types is Shortage Deductions. This article will delve into the intricacies of Amazon shortage claims, the number one deduction type that we help our customers with. We will explore the underlying reasons for these deductions, various types like concealed shortages, and provide you with a professional approach to managing them efficiently.

Are you ready to recover thousands of dollars in lost revenue?

What are Amazon Shortage Claims and The Reasons Behind It?

Anytime when the quantity of a product is less than what is mentioned in the invoice, Amazon issues a Shortage Deduction. There can be various reasons behind the Amazon shortage claims, since there are multiple parties involved in the transportation of the product, but guess who has to pay for the shortages? It's always the VENDOR.

Here are a few common scenarios you should be aware of:

- Miscounts: This is the most common reason for shortage deductions, arising during inventory counting, product packing, or order shipping. To prevent miscounts, meticulous inventory counting methods and tracking systems are essential to identify discrepancies quickly.

- Pilferage: This refers to the theft of products from your inventory and can happen anywhere in the supply chain, from your warehouse to Amazon's fulfillment centers. Securing your warehouse and implementing shipping security measures can help prevent pilferage.

- Damage during shipping: This can happen when your products are handled roughly during shipping. It can cause the products to be damaged, lost, or stolen. To prevent damage during shipping, it's important to package your products carefully and to use a reputable carrier.

- Errors in Amazon's system: In rare cases, shortages can occur due to errors in Amazon's system. This can happen when Amazon's system incorrectly records the quantity of products that you ship or when it incorrectly calculates the number of products that are delivered. To prevent shortages due to errors in Amazon's system, it's important to track your shipments closely and to compare the tracking information to the information in Amazon's system.

Troubled by Amazon Compliance Chargebacks or Pricing Deductions? Check our comprehensive guide on Amazon Chargebacks.

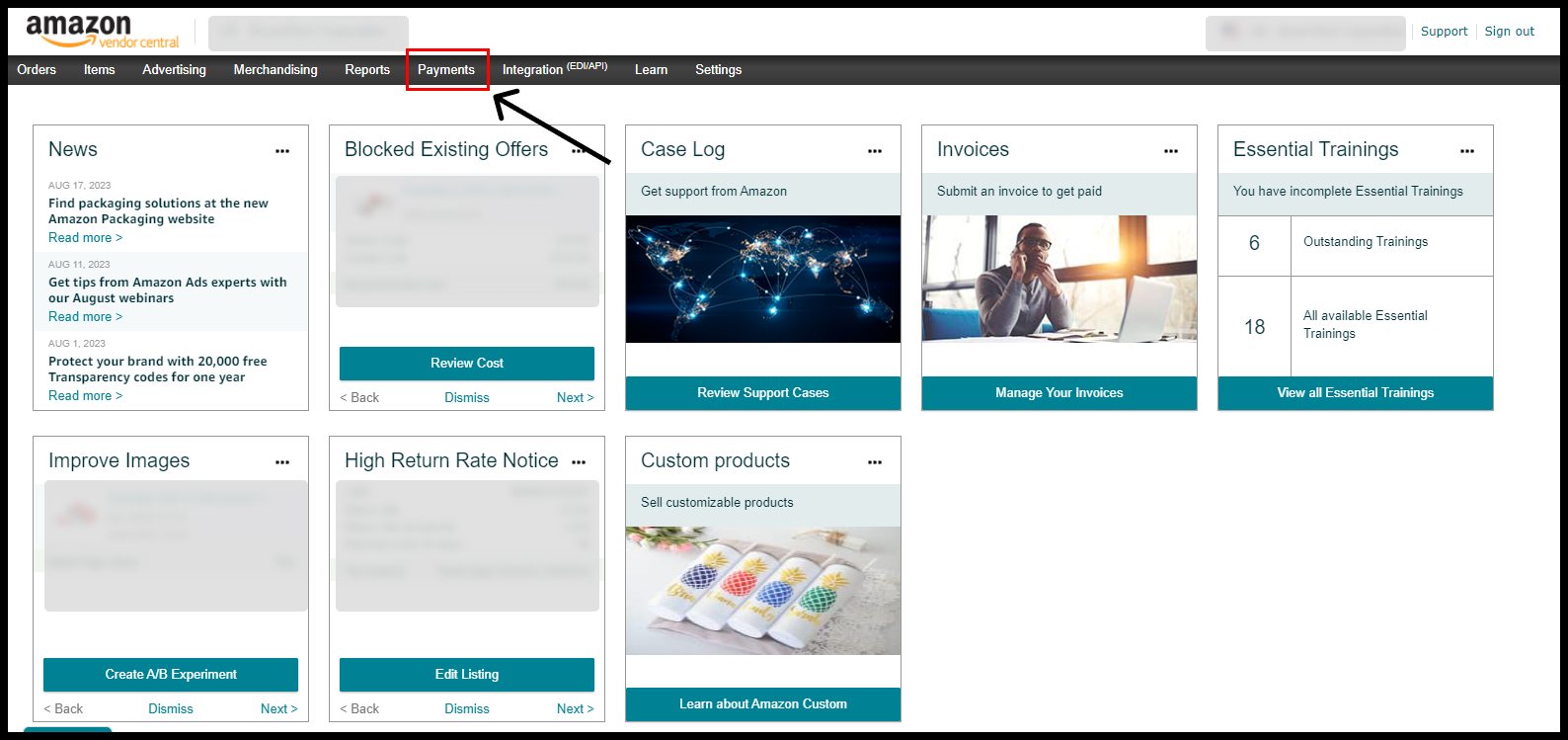

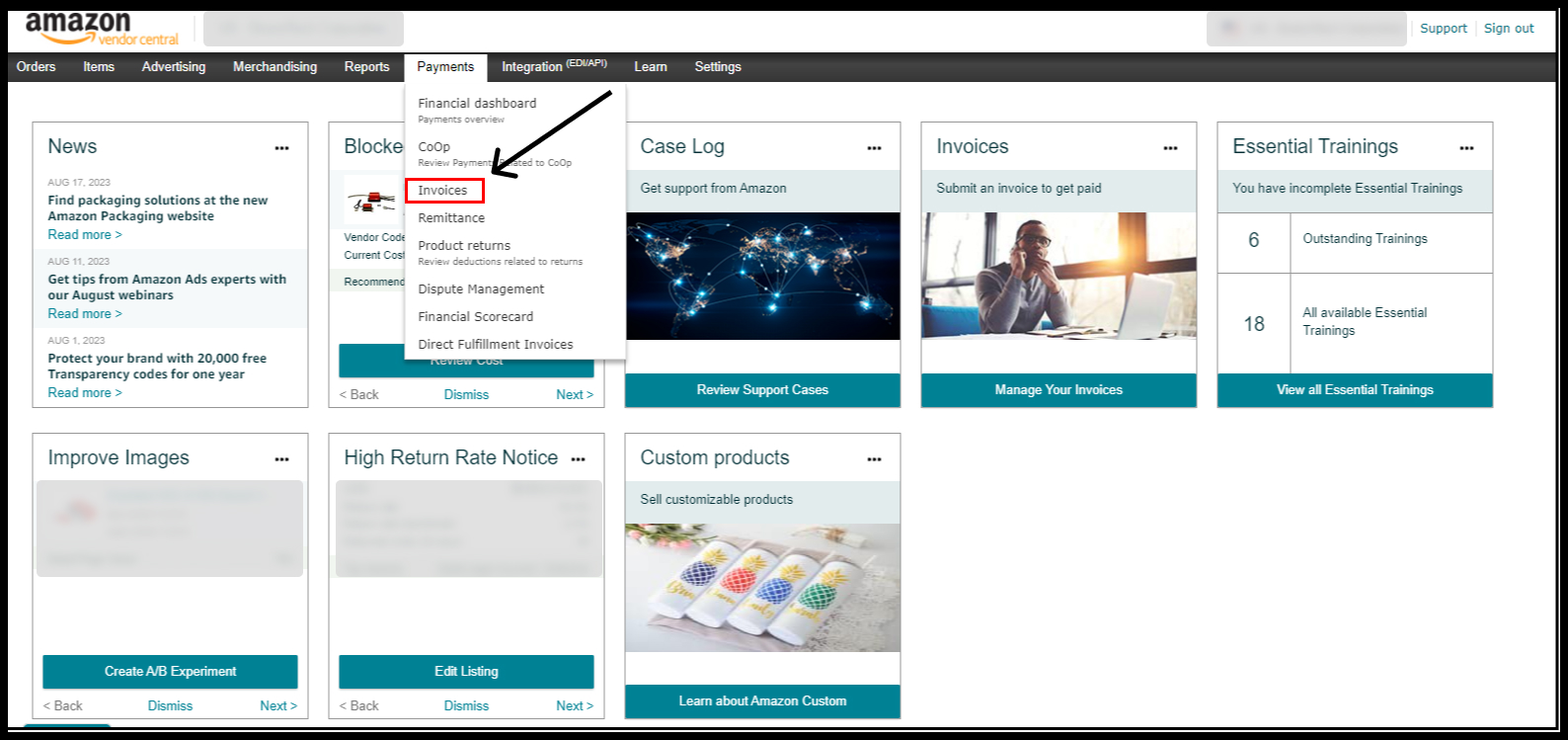

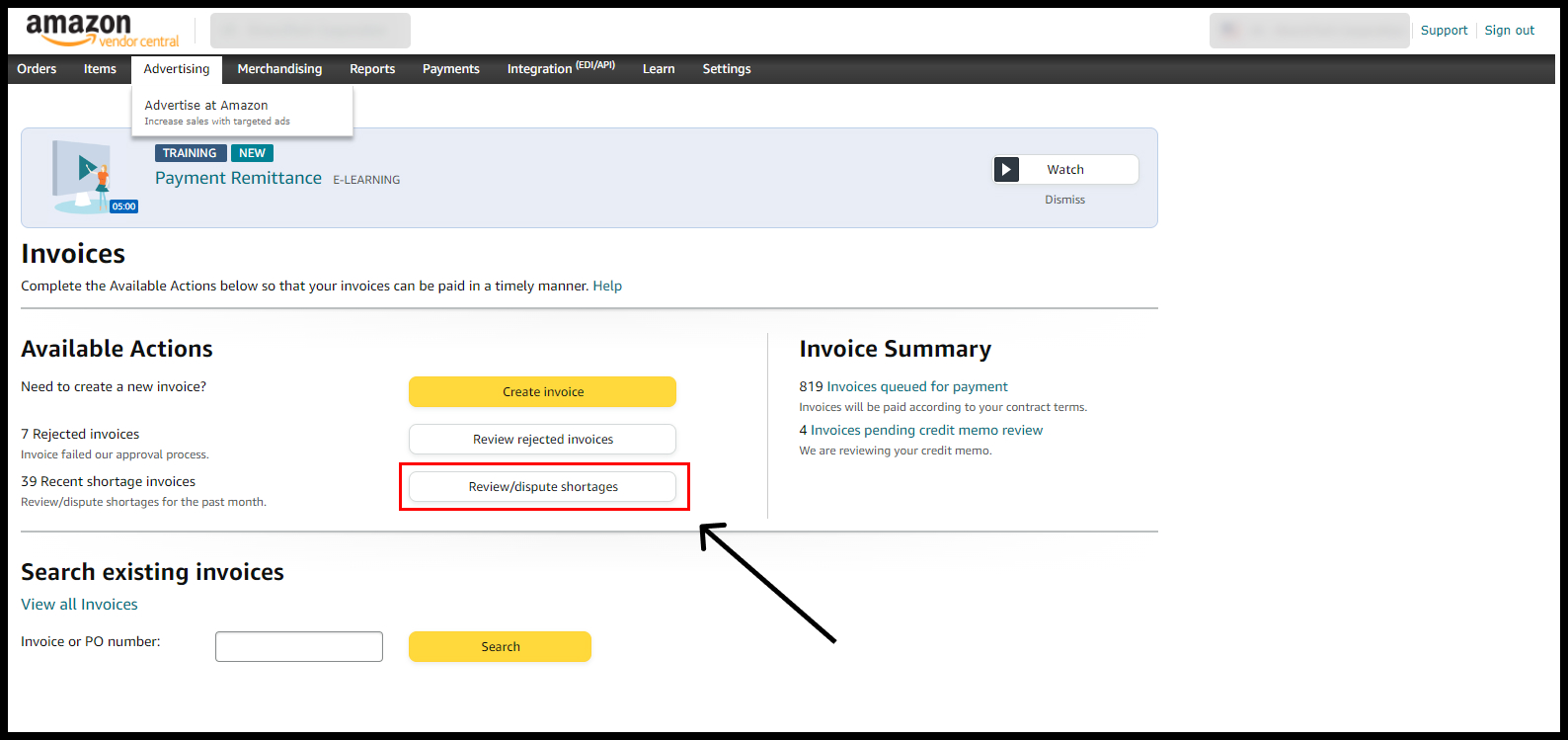

Here's How You Can View Shortage Deductions on Vendor Central

- Payments > Invoices > Review/Dispute Shortages

Here you can view shortage claim for invoice Amazon.

Best Practices to Prevent Deductions

- Proactive Shipment Monitoring: Implement a proactive approach by closely tracking each shipment's progress. As a vendor, this allows you to ensure timely execution of every step. In case of any delays, promptly update Amazon Vendor Central to preempt potential deductions.

- Keep Abreast of Vendor Agreements: Amazon frequently updates its Vendor Regulations, with most changes being minor. However, non-compliance can result in substantial deductions. Thus, it's crucial to stay informed about these alterations and ensure your team adheres to them consistently.

- Efficient Process Standardization: Manually managing every step of the process can be burdensome. Consider utilizing specialized software solutions to streamline and standardize your operations. These tools are highly efficient and cost-effective. Later in this article, we'll delve deeper into these software options.

Best Way To Dispute Amazon Shortage Deductions

Precaution is better than cure! So as a Vendor, your aim should be to prevent these by proactive monitoring. But with an army of robots from Amazon they are inevitable. So you better find an effective cure. Normally disputes are raised against these deductions. Proofs in the form of documents are uploaded manually onto Amazon Vendor Central.

Disputing Amazon charges takes about 15-20 minutes to file a single claim. Imagine you have to handle thousands of deductions every month. Sounds daunting, doesn't it?

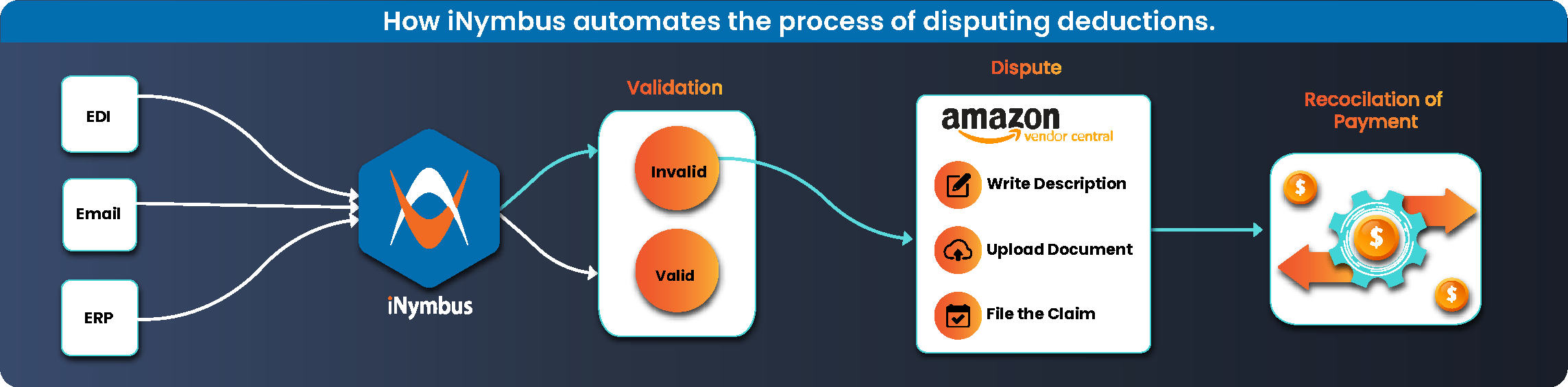

Embracing Automation with iNymbus

We at iNymbus have developed a Cloud Robotic Process Automation which, once trained for your system, can do all the tasks automatically for you. Not only that, it does those tasks 30x faster than a human.

Our Cloud RPA not only processes claims but it goes a step further and helps you prevent those deductions in the first place, by finding the root cause of it. Let us fight this battle for you and win it, just like 200 other companies have done before. Schedule a quick call to know how our Cloud RPA can specifically help you!