What is an Amazon Chargeback?

According to Amazon, a chargeback occurs when a customer contacts their bank or credit card company to dispute a charge for an order they placed on Amazon.com. Also known as "charge disputes" or "reversals" they can be filed for a variety of reasons.

However, Amazon fails to mention on their Chargeback FAQ page that for vendors selling goods on their site, chargebacks can be received for several other reasons outside of customer-driven issues.

Amazon Customer Chargeback Vs. Vendor Chargebacks

An Amazon customer chargeback happens when a customer disputes a transaction conducted via Amazon and seeks a refund directly from their bank or credit card provider. While Amazon vendor chargeback occurs for violating Vendor Regulations.

Things such as packaging non-compliance and other technical or operational errors will also result in chargebacks from Amazon. These chargebacks are also known as “Amazon Vendor Central Chargebacks” or “Amazon Chargebacks For Vendors”.

In this blog post, we will discuss the types of Amazon vendor chargebacks, the reasons behind them, and strategies for preventing them.

Types Of Amazon Chargebacks & Deductions

Deductions cover a range of financial adjustments, from small issues to major penalties. Chargebacks address specific problems like pricing, contract breaches, or invoice disputes. All Amazon deductions can be categorized as follows:

Pricing Discrepancies:

These occur due to mismatches in product pricing, such as differences between the label price and the invoice price, or discrepancies between the purchase order (PO) price set by Amazon and the invoice price.

Shortage Deductions:

These happen when the quantity of products Amazon receives is less than what is indicated on the vendor's invoice.

Amazon Compliance Chargebacks:

Amazon issues these chargebacks to vendors for breaches of the Vendor Agreement, such as incorrect labeling or late shipment notifications, serving as penalties for non-compliance.

If you'd like to learn more about these types of chargebacks, we have an in-depth article on Amazon Vendor Central Chargebacks

Common Reasons For Amazon Chargebacks

So what's the big deal? First of all, whether or not the chargebacks are valid is irrelevant. Vendors have two options: disputing the chargeback, or accepting the chargeback. Disputing is tedious and confusing, especially at high volumes. Some even theorize Amazon intentionally keeps the dispute process complicated and time-consuming to maximize its own profit margin.

As an Amazon vendor, it's obviously a smart idea to take measures to prevent or minimize chargebacks from occurring in the first place, but there is no way to avoid them completely. That said, if you choose to dispute the chargeback, we have completed a case study to identify which Amazon chargebacks are the most recoverable.

Best Practices To Prevent Amazon Chargeback

Compliance Deduction Prevention Practices:

- Review and follow Amazon's vendor agreement, guidelines, and policies thoroughly to ensure adherence.

- Adhere strictly to Amazon's requirements for product labeling, packaging, and shipping to maintain compliance.

- Provide accurate and timely Advance Shipment Notices (ASNs) to facilitate Amazon's inventory management and logistics processes.

- Maintain open communication with Amazon, and promptly address any compliance issues that arise.

Shortage Deductions Prevention Strategies:

- Implement robust counting and quality control measures to ensure accurate item counts, and identify potential issues before shipment.

- Ensure accurate labeling and documentation to minimize discrepancies between shipment quantities and invoices.

- Work with reliable carriers and logistics partners to minimize the risk of pilferage or damage during transit.

Pricing Discrepancies Prevention Strategies:

- Double-check that invoice prices match Amazon's agreed-upon prices to avoid pricing deductions.

- Implement systems to ensure accurate pricing data entry and invoice generation.

- Promptly reconcile and address any pricing discrepancies with Amazon to avoid escalation.

- Leverage electronic invoicing and data exchange systems like Electronic Data Interchange (EDI) to minimize manual errors.

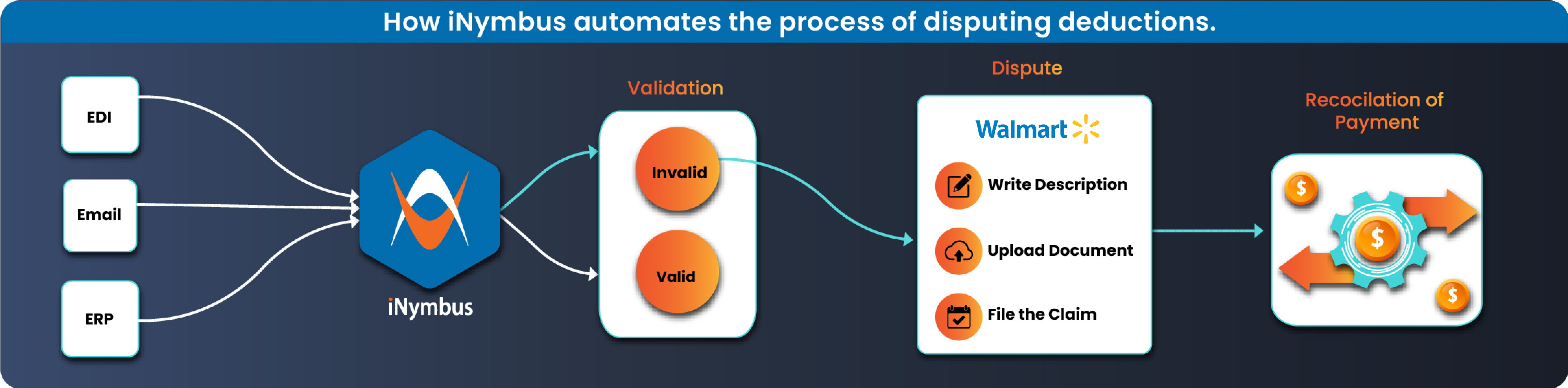

How iNymbus Automates Amazon Chargeback Claims

iNymbus is a deduction management software that leverages Robotic Process Automation to handle Amazon deductions. Our Deduction Management Software is designed to match your company's standard operating procedures and seamlessly integrate with your system. It addresses all types of Amazon deductions, categorizing them for ensuring faster resolution. As your business expands, it can efficiently manage a high volume of deductions.

1: Automated Document Retrieval:

iNymbus automatically scans and identifies Amazon claims from all documentation sources, including portals, EDI, and within email, eliminating manual work, saving time and resources.

2: Claim Validation

After retrieving documents, they undergo a thorough classification process to determine their validity. iNymbus uses a detailed set of Standard Operating Procedures (SOPs) to carefully examine every aspect of each claim, ensuring that no detail is missed.

3: Claim Package Organization

iNymbus sorts the documents by vendor, reason code, and document type (claim, invoice, order, proof of delivery). It then creates a claim package for each claim, organized by vendor and reason code in a manner that aligns perfectly with audit or retailer specifications, ensuring enhanced efficiency.

4: Automated Dispute Resolution

After organizing the documents, iNymbus automates dispute resolution by uploading the organized claim documents to retailers and auto-filling the required descriptions, ensuring seamless efficiency.

.jpg)