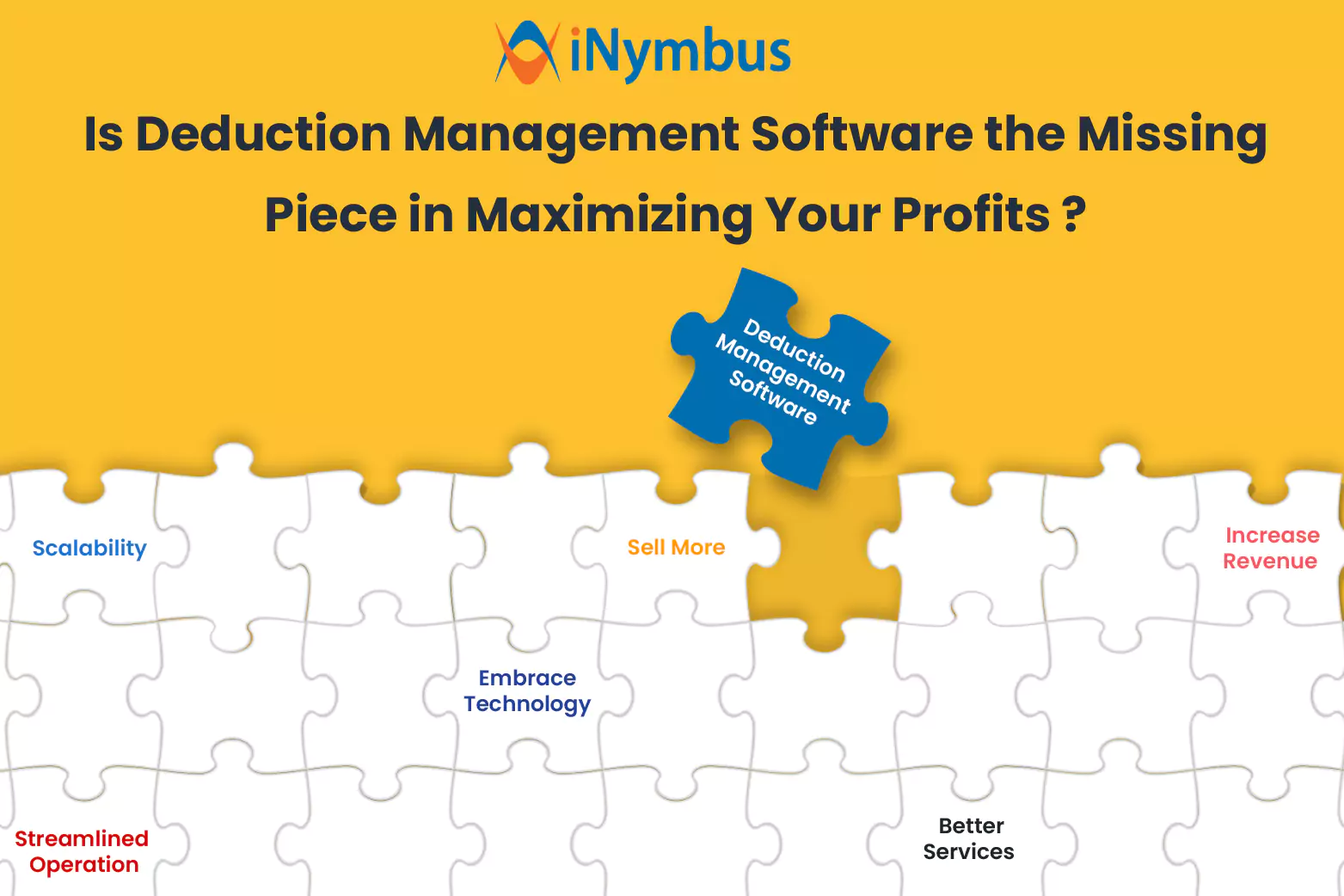

When it comes to running a business, there are a million things that the management has to handle for it to be sustainable and successful. Profit margin is one of those important things that is always monitored and made sure to remain stable, if not increase with time.

To do that in this complex retail business, there are multiple ways from streamlining operations to investing in good technology, but one area that is missed out by most businesses and is slowly eating away their profit margins is deductions.

It is a challenge that most businesses struggle with, and even after trying various strategies, it persists. It affects cash flow, requires countless man-hours to resolve, and takes up a lot of your resources.

So let's dive deep into this topic, we’ll briefly discuss common ways to boost profit margins, learn about deduction and its impact, and most importantly, find the right solution for your business.

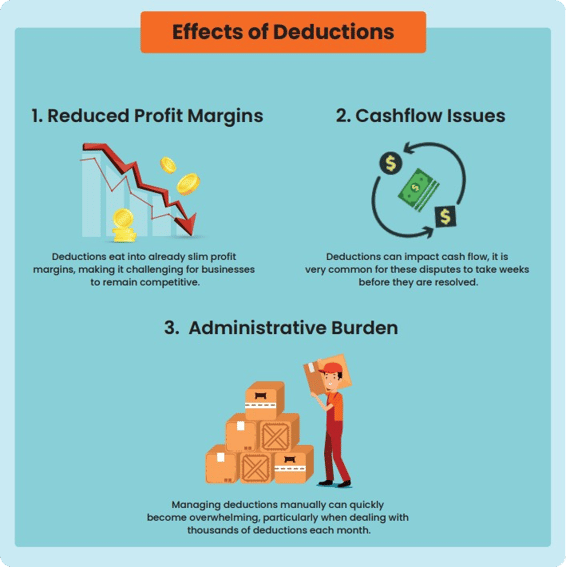

Impact of Deductions

-

Cashflow Issues- It is well known that settling claims takes at least a few weeks and reconciliation of payment takes a few more days. For businesses that have thousands of deductions issued every quarter, that is a lot of money stuck with retailers that could be used for various other things.

-

Increased Expenses- With a high volume of deductions from retailers and tight deadlines you have no option but to add more resources for processing deductions. More people in accounts receivables require more cross-communication, making the process of claim management slower.

-

Reduced Profit Margins- Not resolving disputes on time can lead to penalties and lost revenue. Thus dispute resolution should be a priority in retail industry where margins are already very slim. Automation software can help you track and tackle claims in real-time.

-

Impact On Retailer Ratings- When suppliers are issued deductions and they turn out to be valid, not only is it a financial loss but it is also not beneficial for supplier-retailer relationships. Through deductions, retailers are able to keep compliance in check which will further help in customer satisfaction. Walmart’s OTIF is an example of it.

Solutions Available

-

Outsourcing

As easy as it might seem, outsourcing has various challenges like creating channels between our business and outsourcing company so that the data is transferred smoothly. Not many solutions in the market are able to tackle it smoothly.

-

Onboard More People

A steep learning curve and increasing complexities in deduction resolution make hiring at scale difficult. Perhaps making dispute resolution more challenging for the current employees.

-

Opt for Settlement Disputing

That was once an option given by multiple retailers which was quick and convenient. That being said it had its disadvantages but most retailers now have either discontinued it or will discontinue in near future.

-

Inhouse Automated Workflows

For bigger suppliers handling thousands of deductions every single month, it might make sense to develop an in-house automated or AI-powered claim management software to tackle deductions.

However, the skills and resources needed for deduction automation are often too costly and time-consuming. Outsourcing to the right company can be a more affordable alternative for managing thousands of deductions monthly.

Automated Deduction Management Software: iNymbus

We at iNymbus specialize in managing deductions for businesses of all sizes. We have deeply studied deduction management for years and so we designed our product keeping in mind all the problems that a supplier might face. Here are a few important KPIs that we focus on:

- Cost: Reduce costs by up to 80-90%.

- Efficiency: Increase speed and efficiency by up to 30X.

- Capturing Deductions: Maximizing returns by capturing 100% of claims.

With RPA (Robotic Process Automation) technology, we have been able to automate the process of filing a claim from end-to-end. Here's a brief overview of how iNymbus automates Deduction Management:

Identify Deductions ⏩ Categorize Claims ⏩ Fetch Documents ⏩ File Claim

With years of experience and cutting-edge technology, iNymbus has simplified the onboarding process and so you can start automating disputing deductions within a few weeks.

Learn more about how iNymbus supports 40+ retailers, which is more retailers than most software on the market.

Success stories of companies using AR Deduction Management Software

Case Study 1: iNymbus Clears Years of Walmart Deduction Backlog in Weeks.

A Video Game distributor was struggling with 1,500 monthly claims. The volume was so high, it required one full-time employee and two interns dedicated to working solely on Walmart deduction claims to get the job done.

After handing over thousands of files to iNymbus, in the first two weeks, a month’s worth of deductions had been processed. It wasn’t long after this distributor was caught up on years of deductions backlog, for the first time.

Case Study 2: Large Book Distributor Reduces Cost-per-Claim by a drastic 80-90% for Amazon Chargebacks

Amazon was posing increasing problems for a large book distributor. Razor-thin margins were rapidly eaten by deductions and chargebacks. The high volume of the book distributor’s transactions created thousands of chargebacks every single month.

In about 90 days, the book distributor implemented iNymbus’ automated solution and brought their chargebacks to zero.

Schedule a quick discovery call and let's discuss how iNymbus can specifically help your business generate maximum profits.

.jpg)