Welcome to our comprehensive guide on understanding and managing Target Deductions. As a vendor, comprehending the significance of these deductions and their impact on your business is crucial.

This article delves into the significant issues arising from an excessive volume of deductions, provides a fundamental understanding of Target's deduction system encompassing its diverse categories, and offers pragmatic approaches for effectively handling these deductions. Armed with this knowledge, you'll be well-equipped to navigate supplier deductions.

Unveiling the Impact of High Volumes of Target Claims:

- Reduced Profit Margins: Accumulated deductions impact profits significantly, hindering business growth.

- Operational Inefficiency: Manual deduction management is time-consuming and resource-intensive.

- Lack Of Visibility: Identifying root causes becomes challenging without specialized systems.

Overview Of Target Deduction Types:

All Target Deductions fall into one of the following categories bulleted below.

- Invoice Match Deductions: This category encompasses instances where discrepancies arise in terms of shortages, price variations, or substitutions in the invoices submitted by suppliers. These deductions are aligned with the need to ensure accuracy and consistency in financial transactions.

- Return-Damage-Defective Deductions: Under this category, deductions are linked to various aspects, including damages incurred during shipping, products returned from store shelves due to a range of reasons, and deductions related to defective items. This category reflects the challenges associated with maintaining product quality and condition throughout the supply chain.

- Compliance Deductions: In the context of compliance, deductions are centered around the adherence to predetermined standards and benchmarks. These encompass deductions related to punctual delivery and shipping, ensuring that products reach their intended destinations within specified timelines, as well as deductions tied to the achievement of desired item fill rates, contributing to efficient inventory management.

- Contractual Deductions: This category encompasses deductions that are contractual in nature and primarily involve the implementation and management of promotions, discounts, and other agreements between Target and its suppliers. These deductions serve as a means to align strategic objectives and maintain mutually beneficial collaborations.

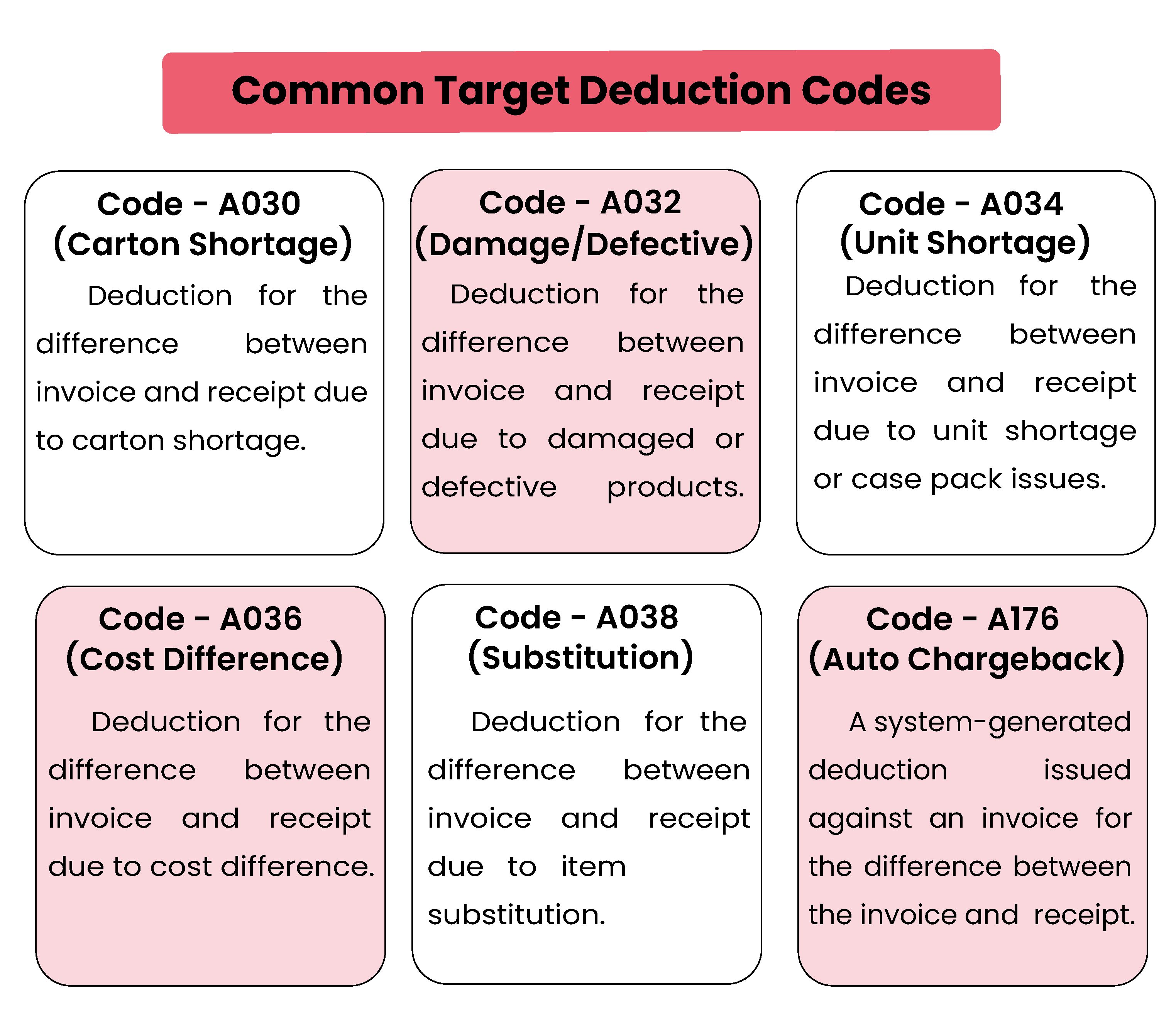

Suppliers may receive deductions from Target for various reasons, each indicated by a specific code (e.g., A030) that represents a particular rule violation. Suppliers are then tasked with proving their case, even if the issue originated from the retailer's end.

Common Target Reasons Codes

You can check full list of Target deduction codes here.

How To Navigate On Target’s Partners Online To View Deductions

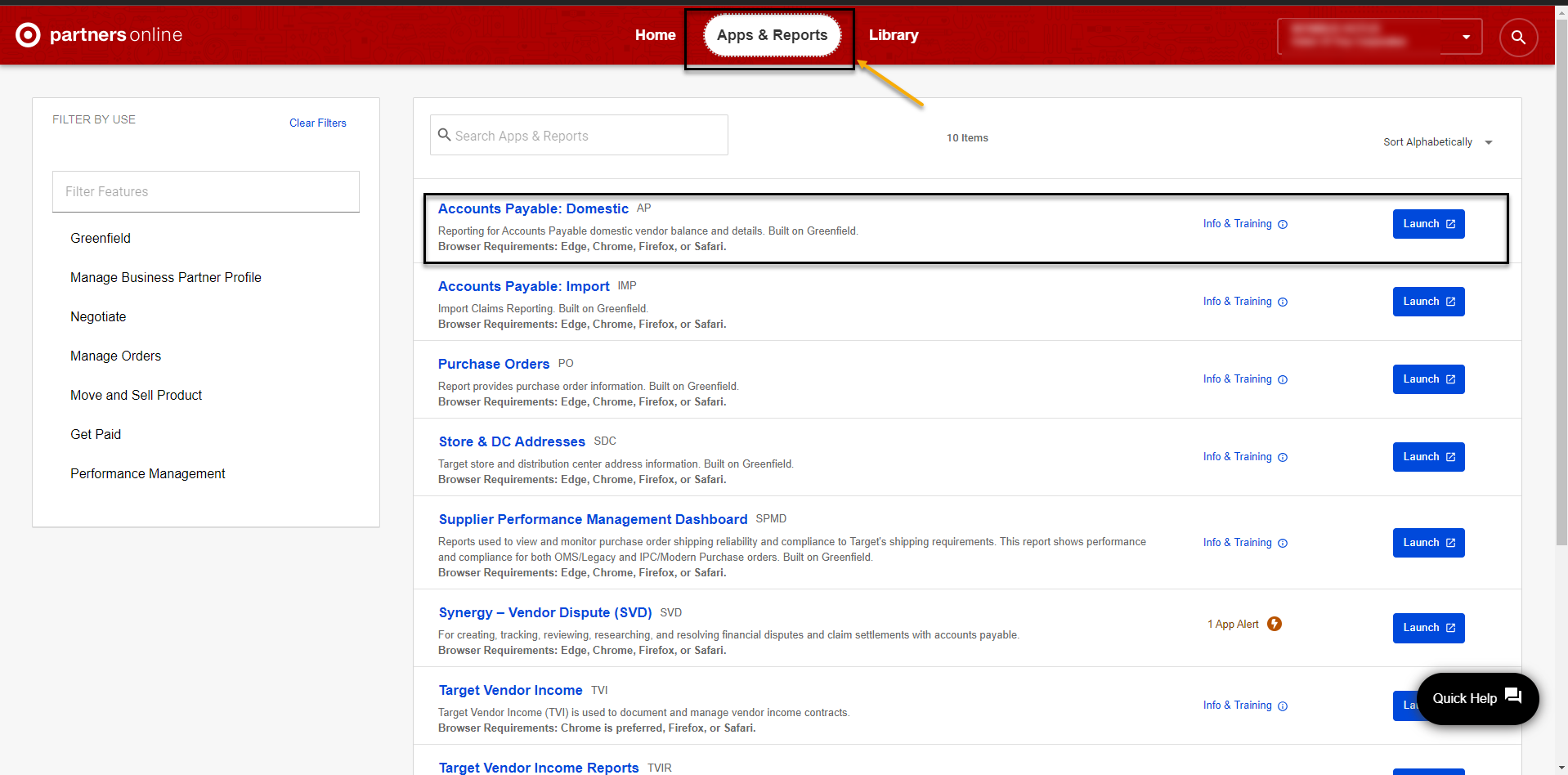

Target's 'Partners Online' is a comprehensive platform designed to grant suppliers access to various apps and reports.

To view deductions related to a particular payment, follow this pathway:

Apps and reports > Accounts Payable > Payment Information > Click On Payment Number

How To Dispute Target Deduction On Partners Online

Synergy is an application where you can dispute a Target Deduction and check the status of each deduction.

Here's a step-by-step guide to the process:

- Search for Invoice or Deduction number

- Describe the type of deductions

- Describe the reason for disputing

- A brief explanation of the situation

- Look for proof on various portals

- Attach proof documentation (POD, BOL.. etc.)

- Wait for approval/denial

It is essential to bear in mind that you have a 90-day window from the date of deduction issuance to initiate a dispute via Synergy. What makes this process tedious and time-consuming is accessing various portals to collect required documents and repetitive tasks needed to be performed for each deduction. Performing all these tasks for a single deduction can take anywhere from 15 to 20 minutes.

Now imagine you have to dispute thousands of them every single month, sounds daunting, doesn't it?

Disputing Target Claims thorough iNymbus

Imagine effortlessly navigating retailer portals, EDI, and document sources with cutting-edge Deductions Management Software.

Picture a world where duplication of work and manual steps become a thing of the past, all while gaining real-time insights into claim status across retailers. Intrigued?

iNymbus has the ability to process all types of target claims like

- Target Shortage Claims

- Target Return Claims and

- Target Un-Paid Invoices claims

Discover how this transformation is possible with our game-changing RPA solution at iNymbus.

Visit our pages dedicated to Amazon and Walmart Deductions for more info.