Did you know that almost 80% of Americans made purchases in advance to celebrate the 4th of July? While this surge in sales is great for businesses, it brings major challenges for suppliers.

One of those challenges is managing deduction backlogs. If you have dealt with retailers like Amazon and Walmart, you know how quickly these backlogs can pile up, causing cash flow problems and reduced revenue.

But don't worry, that's exactly the problem we’ll be addressing in this article. We’ll explore how you can swiftly clear deduction backlogs using automated solutions.

Understanding Deduction Backlogs

Deduction backlogs happen when there's a sudden increase in purchase orders (POs) from retailers, common during peak sales periods like Independence Day, Christmas, and Black Friday. With this sudden rise in demand, suppliers are bound to make a few mistakes, leading to some deductions.

An even bigger problem is the numerous invalid deductions that come along with the valid ones. While employees are busy managing the surge in POs, this becomes an added task for them. These backlogs can lead to major cash flow issues and missed deadlines for disputing deductions.

For more information, check out our recent webinar on Retailer Chargebacks & Deductions

Impact of Deduction Backlogs

The impact of deduction backlogs on businesses can be severe. Financial services are strained, leading to cash flow problems that can affect operations. Missing the deadline to dispute deductions can result in significant revenue loss. For example, imagine a supplier dealing with a high volume of POs from a major retailer. Without efficient deductions processing, they risk drowning in paperwork and losing valuable income.

The Role of Automation

Enter robotic process automation (RPA). Automation can dispute invalid deductions 30 times faster than manual processes. This digital transformation is important for staying ahead in today’s fast-paced market.

Automation has revolutionized various processes in the finance industry, bringing about significant improvements in efficiency and accuracy. Here are a few examples:

-

Reconciliation: Reconciliation tools can compare transactions in real-time, identify discrepancies, and resolve them quickly. This removed inaccuracies in financial statements.

-

Invoice Processing: Automated systems can compare data from an invoice, match them with POs, and process payments if there are no differences. This speeds up the payment cycle and reduces errors on both ends.

-

Expense Management: Expense management before automation was full of manual data entry and receipts. With automation, employees were able to add data using mobile devices.

Embracing automation is no longer optional; it’s a strategic necessity for any company looking to thrive in a competitive landscape.

Check our case study where we help suppliers tackle Walmart Deductions.

How iNymbus Automation Can Help You Clear This Backlog

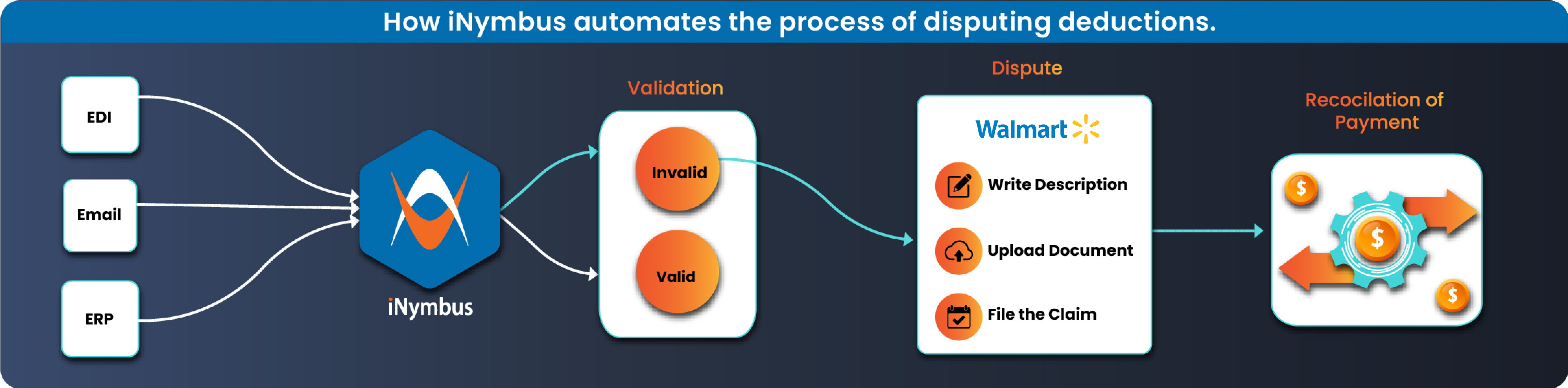

iNymbus with the help of RPA technology simplifies and automates this process. Here’s how our deduction management software does it:

-

Identifying New Deductions: Our system is able to automatically identify when a new deduction is issued.

-

Validating Deductions: Next with the help of SOP it is able to tell if the deduction is valid or not.

-

Fetching Proof of Documentation: For all the invalid deductions, our system is able to auto-fetch documents from a variety of sources like ERP, EDI, and emails.

-

Filing Claims: Now that it has collected documents, it can automatically file the claim on the retailer portal.

-

Checking Reconciliation of Payments: Finally, it verifies the reconciliation of payments to ensure everything is accounted for.

By chargeback automation, iNymbus not only clears backlog swiftly but also enhances overall operational efficiency, allowing your Accounts Receivable (AR) team to focus on more strategic tasks.

Conclusion

Clearing deduction backlogs swiftly after the Independence Day sale is crucial for maintaining healthy cash flow and maximizing revenue. With our automated deduction management software, you can efficiently manage deductions, improve customer service, and stay ahead of the competition. Don’t let deduction backlogs hold you back—embrace automation and transform your deductions processing today.

Ready to transform your deductions management? Fill out the form for a quick discovery call to see how iNymbus can help your business automate deduction management and overcome backlog challenges.