First, let’s start with what deductions are. In our context, deductions are fees imposed by major retailers like Amazon or Walmart on their vendors. These fees are a response to perceived violations related to shipping, compliance, or other vendor responsibilities. Deduction management refers to the process of handling and resolving deductions issued by retailers.

Why Do You Need Deduction Management Software?

Managing deductions can be a significant challenge for businesses. Accounts receivable teams often spend a considerable amount of time manually handling these deductions, leading to bottlenecks and delays. As the volume of deductions grows, the limitations of manual deduction processes become clear.

Deduction management software helps streamline tasks such as:

- Identifying Deductions: Quickly identify and categorize deductions based on their type.

- Retrieving Documents: Access and gather the supporting documents needed to dispute claims easily.

- Organizing and Packaging Claims: Efficiently organize and package claims for submission to retailers.

- Dispute Resolution: Automates dispute resolution by uploading organized claim docs to retailers, and auto-fills required descriptions for seamless efficiency.

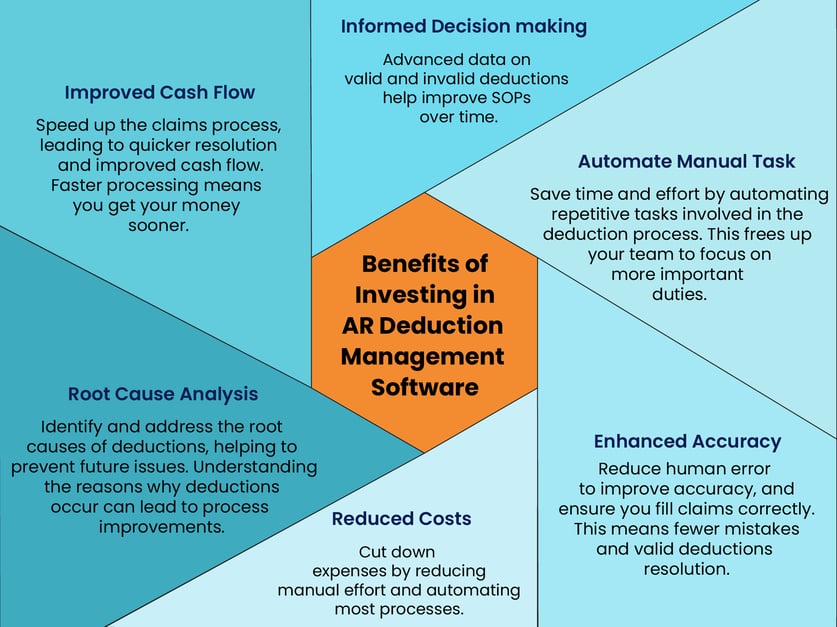

Benefits of Investing in AR Deduction Management Software

Must-Have Features in Deduction Management Software

It’s important to look for features that provide the most value to your business.

- Wide Retailer Support: Vendors working with multiple retailers face a heavy workload when dealing with deductions. It's hard for them to find one solution that does everything they need. The software supporting a wide range of retailers makes managing deductions from various sources much simpler.

- Cloud-Based Solution: Cloud-based software provides the scalability to manage high volumes of deductions without requiring additional resources. It allows for easy adjustment to handle seasonal spikes in volumes. This scalable solution enables businesses of all sizes, whether small startups or large enterprises, to efficiently manage deduction processes.

- Integration Capabilities: The software needs to be able to meet the specific needs of the business and offer a lot of customization options. The software must meet the business's specific needs and provide many customization options. It should be compatible with existing ERP systems. Additionally, it should connect with various platforms and tools to enhance its features.

- Advanced Reporting and Analytics: Detailed reports and real-time data give valuable insights about trends, causes, and patterns. This helps find areas to improve and solve problems before they happen.

- Document Retrieval: Document retrieval makes it easier to collect and organize important documents like invoices, proof of delivery, and contracts related to deductions. This helps save time, reduce mistakes, and increase efficiency in resolving disputes quickly.

How iNymbus Overcomes Traditional Challenges

We understand the pain businesses face when it comes to managing deductions effectively. That's why our solution is designed to address and overcome the common pitfalls associated with traditional approaches and make it the best deduction management software there in the market.

iNymbus uses cloud-based robotic process automation (RPA) to handle the whole deduction management process. This includes identifying and validating deductions, and filing disputes. Our automation reduces the need for manual work, cuts down on errors, and speeds up resolution times.

Unique Features of iNymbus:

- 40+ Retailer Support: iNymbus works with over 40+ major retailers, making sure all your business needs are covered. Our software can manage a diverse deduction claim types, such as shortages, chargebacks, returns, and pricing discrepancies. If you have special requirements, we can handle those too, just like we have for many of our clients.

- Email Disputes: While support for big stores like Amazon, Walmart, and Target usually have specific dispute portals, it is common. But smaller ones like Nordstrom or Ulta handle disputes through email. iNymbus uses standard procedures to send emails with descriptions and attached documents to file the dispute.

- All-in-One Solution: iNymbus is more than just traditional software. We understand that retailer requirements go beyond deductions. That’s why we also support freight claims from various carriers such as UPS and FedEx. Moving forward, we also handle return variance reconciliation.

- Centralized Deduction Hub: One important factor that many businesses often overlook is the importance of visibility. Our software comes with a user-friendly centralized deduction hub for a unified view of deductions from all retailers for improved visibility.

- Automated Document Retrieval: iNymbus retrieves important documents like invoices and bills of lading automatically from ERP systems, portals, EDI, and emails. Vendors don't have to collect and organize these documents manually anymore. This saves time and reduces mistakes.

How a Client with $2 Billion in Annual Revenue Tackled Deductions with iNymbus

A top company with brands in beauty, health & wellness, and home & outdoor, making over $2 billion a year, wanted to improve its deduction management. They used to have a 40-person team manually handle deductions for big retailers like Amazon and Walmart, which took weeks and caused delays and inefficiencies.

The company utilized iNymbus’ Solution and set up Standard Operating Procedures (SOPs) for automation. This change cut processing time from hours to minutes by automating document retrieval and claim processing. As a result, they gained better visibility, improved reporting, and significantly reduced costs, needing only two staff members to manage exceptions.