Navigating Kroger's intricate world of deductions as a supplier is of paramount importance, as these financial adjustments directly impact your bottom line. In this comprehensive guide, we will shed light on Kroger deductions, the challenges they pose, the various deduction codes, claim types, and the dispute process.

Understanding Challenges of Kroger Deductions

-

Increase in Volume of Deduction

Kroger's deductions have seen a surge in volume in recent years. It is essential for suppliers to grasp the reasons behind this increase and how it can affect their business. The rise in deductions is often attributed to discrepancies or issues related to invoicing, compliance, or other operational areas. -

Accuracy in Filing

Once a deduction is submitted, no changes can be made. Therefore, utmost accuracy is essential when filing deductions. Even minor errors can lead to unwarranted financial losses for suppliers. It is vital to double-check all documentation and calculations before submitting any deductions.

Kroger Deduction Codes

Unlike other retailers with a multitude of deduction codes, Kroger simplifies matters with only eight deduction codes. Let's briefly discuss each one of them:

- Code 2 - Promo Allowance Difference (OI)

This code is issued when Kroger does not receive the agreed-upon promotional allowance from the supplier, which is typically meant to incentivize the retailer to promote the supplier's items. - Code 3 - Cost Difference

Code 3 is issued whenever there is a discrepancy in the unit price of a product. - Code 4 - Shortage/ Damage

Code 4 comes into play when Kroger receives fewer products than what is mentioned in the invoice. - Code 5 - EDI Noncompliance

If Kroger doesn't receive invoices via Electronic Data Interchange (EDI), they issue code 5. - Code 6 - Not Received (similar to code 4)

Code 6 is also related to situations where Kroger receives fewer products than expected. - Code 7 - Overage

In cases where Kroger orders a specific quantity but receives more, a positive deduction is issued under code 7. - Code 8- Net Total Difference

Code 8 is employed when Kroger cannot automatically determine a discrepancy, whether it's related to the price or quantity of the product. - Code 9 - Pickup Allowance

Whenever Kroger's carrier picks up a purchase order, code 9, which pertains to freight charges, is issued.

Claim Code to Use Against Each Deduction

When disputing a deduction, it's crucial to use the appropriate claim code on Lavante. Here are the specific claim codes for each deduction:

- OI - Off Invoice (For Code 2)

- LC - List Cost (For Code 3)

- SH - Shortage (For Code 4, 5, 8)

- OV - Overage (For Code 7)

- PU - Pickup Allowance (For Code 9)

We also have a dedicated page for Walmart Deduction Code, do check it out if you want to automate Walmart Deductions.

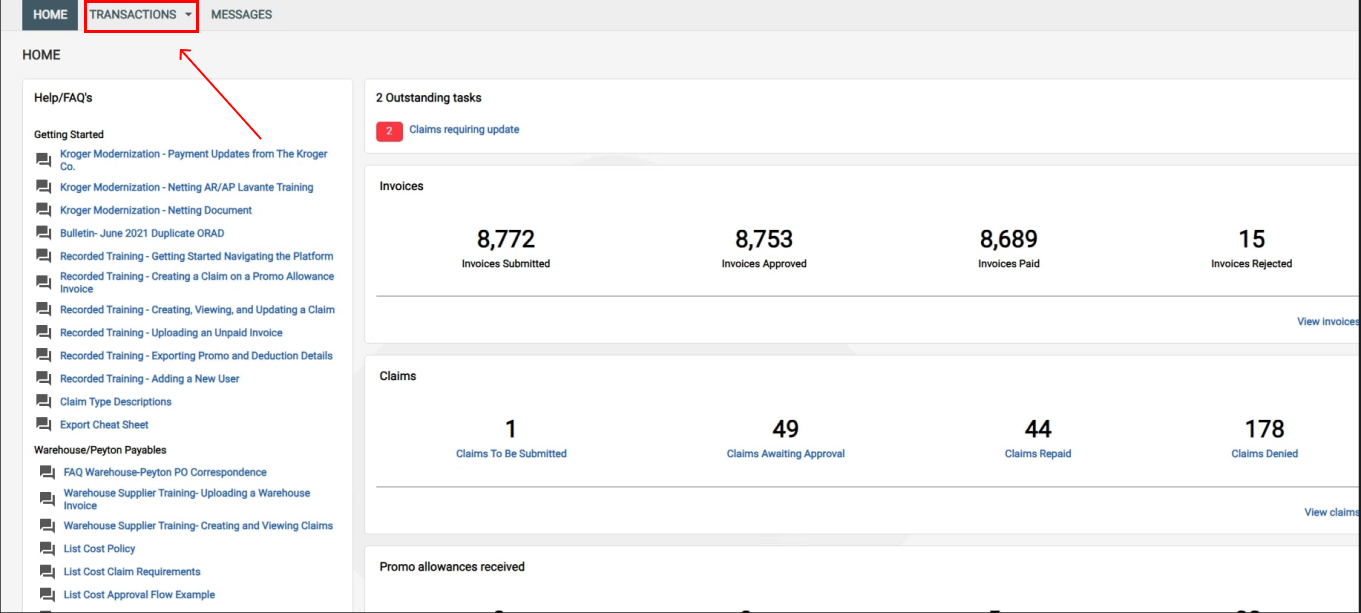

How To View Kroger Deductions On Lavante Kroger

To view Kroger deductions, you can access Kroger's dedicated platform called Lavante Kroger, where you can also dispute any deductions. You can follow the following path to view all your deductions:

Login > Transactions > Payments

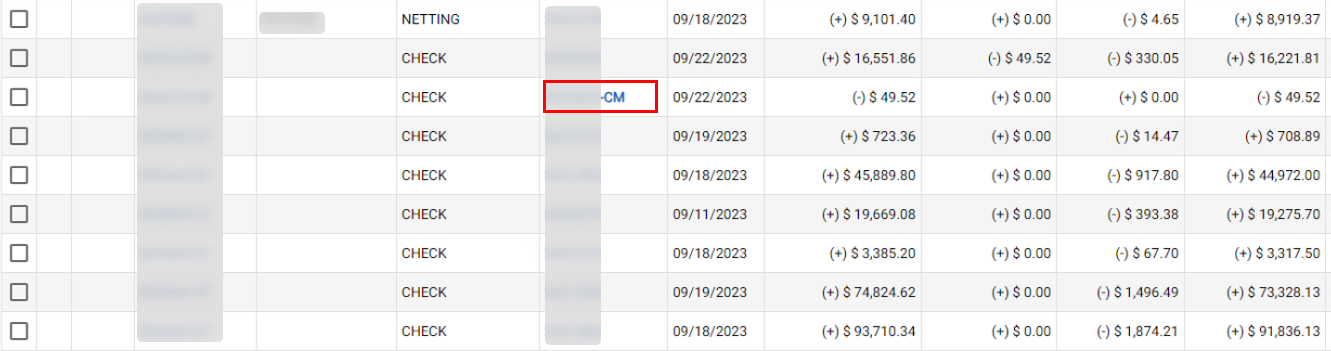

Note: You will find all the payments here. To identify payments with deductions, look for payment numbers that end with "CM".

Note: You will find all the payments here. To identify payments with deductions, look for payment numbers that end with "CM".

Dispute Process on Lavante Kroger Portal

Dispute Process on Lavante Kroger Portal

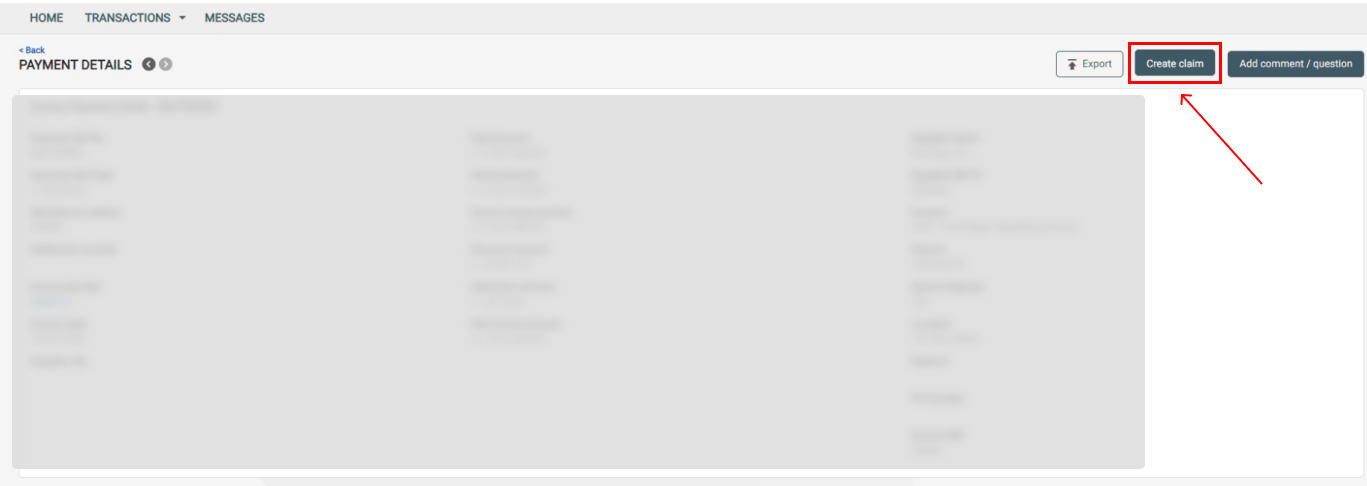

- Once you locate the payment with a deduction, click on that payment. On the new page, you will find an option to "create a claim," indicating your belief that the deduction is invalid.

- You now have to fill in the following details:

- Claim Type

- Claim Amount

- Claim Description

- In the next step you have to attach the supporting documents. That's it you have successfully created a claim

- The claim will have one of these four statuses.

- Open

- Pending

- Pending update

- Closed

Documents Required to Dispute Kroger Deductions

Code 2 - Promo Allowance Difference: Promo agreement, Invoice

Code 3 - Cost Difference: Invoice, Purchase Order

Code 4 and 6 - Bill of Lading (BOL), Proof of Delivery (POD), Invoice

Code 8 - Approval, Purchase Order, Invoice

Code 9 - Pickup Allowance: Invoice, Shipping Documents

Disputing Kroger Deduction with iNymbus

Manual deduction disputes can be tedious, but iNymbus transforms this process, leveling the playing field when confronting the retailer. Here's how automating deduction management with iNymbus makes a difference:

- Cost Efficiency: iNymbus significantly reduces costs by 80-90% per claim, making deduction management highly economical.

- Complete Claim Coverage: iNymbus enables you to handle 100% of all claims, a level of coverage that's challenging to achieve manually.

- Advanced-Data Insights: Utilizing its cutting-edge data analysis capabilities, iNymbus efficiently identifies the underlying causes of deductions, offering valuable insights for issue resolution.

- Swift High-Volume Handling: iNymbus excels in managing high volumes of deductions with remarkable speed, ensuring no deductions are left unattended, even during peak periods.

We can help you manage deductions not only from Kroger but also from every retailer, whether it's Amazon or Walmart. iNymbus is your one-stop solution for all deductions.

This festive season, we're offering a complimentary audit and a 30-day free trial. Click to claim your offer now!