Navigating the complexities of deduction management is a common struggle for businesses, especially those dealing with high transaction volumes. In this article, we'll explore the challenges faced in deduction management and discover how iNymbus, a leading software company, addresses these issues with its automated solutions.

Let's delve into the major problems suppliers face in deduction management and explore how iNymbus effectively addresses each one, providing innovative solutions to streamline the entire process.

Deduction Management Challenges:

1. High Volume:

Managing a large number of deductions can be overwhelming, leading to errors and delays.

Solution: iNymbus' cutting-edge automated deduction management software is designed to efficiently handle large volumes, ensuring meticulous processing even in high-demand scenarios like Black Friday and Christmas Holidays. Backed by numerous case studies, our platform has consistently proven its capability to assist suppliers in swiftly clearing years of backlog within mere weeks.

2. Cashflow Problems:

Deductions can impact cash flow, it is very common for these disputes to take weeks before they are resolved, affecting day-to-day operations and financial stability.

Solution: Mitigating the impact on cash flow, iNymbus not only expedites the deduction resolution process but also offers a real-time tracking mechanism. This enables businesses to stay informed about the status of disputes until payment reconciliation, preventing prolonged disputes from adversely affecting day-to-day operations and overall financial stability.

3. Low-Profit Margins:

Deductions eat into already slim profit margins, making it challenging for businesses to remain competitive.

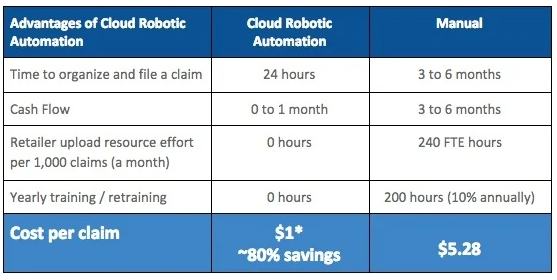

Solution: In addressing the challenge of deductions impacting slim profit margins, iNymbus stands out with an impressive track record. By reducing deduction processing costs by almost 80%, our platform empowers businesses to optimize their financial health. Furthermore, leveraging detailed insights from iNymbus, suppliers have successfully trimmed valid deductions by up to 60%, safeguarding and even enhancing profit margins.

4. Tight Deadlines:

Meeting deduction resolution deadlines is crucial, but manual processes often result in delays. For most types of Amazon Deductions, it is 90 days.

Solution: Recognizing the importance of meeting deduction resolution deadlines, iNymbus steps in to accelerate the entire dispute resolution process by up to 30 times. This remarkable speed ensures that businesses never miss a deadline, all while upholding the precision and accuracy required in handling deductions.

Problems with Current Market Solutions and How iNymbus Stands Out

1. Manual Intervention Dependency:

Many deduction management solutions require manual intervention, functioning only on a semi-automatic basis. iNymbus stands apart by providing a fully automated system, significantly reducing the need for manual input.

This not only minimizes errors but also ensures a more efficient and streamlined deduction resolution process, saving valuable time and resources for businesses.

2. File Compatibility Challenges:

In the dynamic landscape of deduction management, incompatibility between file formats can become a major roadblock. iNymbus addresses this challenge with its software that supports a diverse array of file formats.

This commitment to file compatibility enhances the flexibility of the deduction management process, allowing businesses to seamlessly integrate and adapt their systems without the hassle of format-related complications.

3. Limited Retailer Support:

Unlike many solutions in the market that primarily cater to big retailers and support only Amazon Deductions and Target Deductions, iNymbus stands out by offering extensive support for over 40+ retailers.

Through this cooperative approach, businesses and retailers work together seamlessly, leading to an enhanced deduction resolution process. The outcome is a deduction management system that is both efficient and responsive, minimizing disruptions for all parties involved.

Check out our case study of a client who tackled deductions from more than 40 retailers with the help of iNymbus: Deduction Management Software.

4. Suitability for Large Enterprises Only:

While some deduction management solutions cater exclusively to larger enterprises, iNymbus recognizes the diverse landscape of businesses. Its scalable solutions are designed to be inclusive, offering effective deduction management tools for businesses of all sizes.

By democratizing access to these tools, iNymbus empowers smaller businesses, ensuring that they, too, can benefit from advanced deduction management strategies previously thought to be exclusive to larger counterparts. This levels the playing field, allowing businesses of any size to optimize their deduction management processes.

Conclusion:

By addressing the key challenges in deduction management through advanced automation and comprehensive solutions, iNymbus stands out as a reliable partner for businesses seeking to streamline operations, enhance cash flow, and maintain healthy profit margins.