Home Depot Supplier Hub: Disputing Home Depot Deduction with iNymbus

Understanding and effectively managing vendor deductions from Home Depot are fundamental to running a successful and profitable vendor operation. Vendor deductions, which are deducted amounts from a vendor's invoice, can have a significant impact on your business's profitability. Therefore, having a strategy for reducing, resolving, and preventing these deductions becomes paramount when working with a major retailer.

This Home Depot vendor guide will discuss the complexities of Home Depot Claims and offer best practices to mitigate their impact on your revenue.

What are Home Depot Vendor Deductions?

Vendor deductions are specified amounts taken off a vendor’s invoice when certain conditions agreed upon in the vendor-retailer agreement aren't met. Big-name retailers, including Home Depot, impose many types of vendor deductions - from packaging errors and late shipping to early payments. As such, vendor deductions serve as financial motivators for vendors to adhere to the retailer's stringent requirements.

It's important to note that while Home Depot accounts payable may issue these deductions, not all of them are necessarily valid, and suppliers should be prepared to dispute any that they believe are unjustified.

Common Reasons for Vendor Deductions at Home Depot

Home Depot may apply deductions to a vendor's invoice due to various reasons. These range from simple-to-understand issues such as pricing discrepancies or incorrect quantities to more technical matters like packaging and labeling errors. For instance, should a vendor's order arrive later than agreed, a late delivery chargeback may be issued. Such issues underline the need for careful adherence to Home Depot's vendor requirements.

Most Common Deductions at Home Depot

In the vast ocean of vendor deductions, a handful of them seem to frequently dot the landscape. These deductions significantly impact the invoiced amount and should therefore be keenly understood for effective deduction management. The most common deductions that vendors encounter include:

- Invoice Exceptions: These deductions occur when the information on the invoice does not match up with Home Depot's records. The discrepancies may pertain to product descriptions, quantities, pricing, or terms of delivery. It's essential that vendors double-check the accuracy of all invoice details prior to dispatch to avoid these exceptions.

- ASN Inaccuracy: The Advance Shipping Notice (ASN) plays a critical role in Home Depot's ordering management. All suppliers are required to provide an ASN, detailing the specifics of each shipment, including product details, quantities, shipping, and packaging details. Any discrepancies or inaccuracies in the ASN can lead to deductions.

- Home Depot Shortages: If the quantity of products delivered is less than what was ordered or detailed in the ASN, Home Depot will apply a shortage deduction. Implementing stringent quality control checks at the dispatch level can greatly help in ensuring the delivered quantities match with those ordered.

- EDI Non-Compliance: Home Depot uses Electronic Data Interchange (EDI) to streamline its ordering, invoicing, and payment procedures. Compliance with EDI requirements is crucial. If you are not compliant with the agreed-upon EDI requirements, you may be subjected to an EDI non-compliance deduction.

Understanding the intricacies of these common deductions is the first step to minimizing their occurrence. By taking proactive measures to ensure invoice accuracy, adherence to ASN requirements, avoiding shortages, and ensuring EDI compliance, they can be effectively managed.

Additionally, it's worth mentioning that other major retailers, such as Walmart, have their own sets of deductions that are equally crucial to address.

For a guide on managing Walmart deductions, please check out our in-depth resource on the topic.

Home Depot Supplier Hub Policies and Procedures

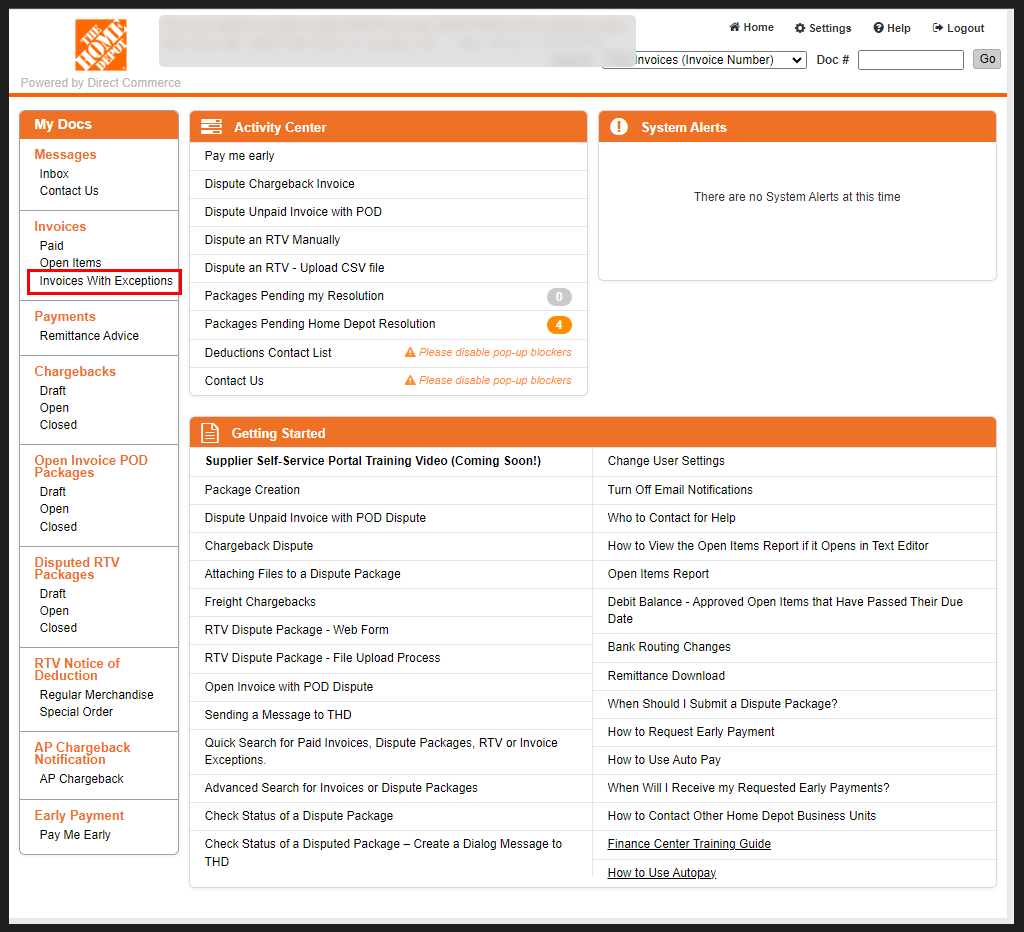

One can find all the information about vendor deductions on Home Depot’s own portal called “Home Depot Supplier Hub”. Early familiarization with these processes allows vendors to take proactive steps to comply and minimize the possibility of deductions.

Home Depot provides vendors with clear deduction policies and procedures, typically outlined in a deductions management guide. From specifying the reasons for deductions to the steps for disputing unjust deductions and practices for avoiding deductions, these guidelines need to be thoroughly understood.

Best Practices for Dealing with Vendor Deductions

To effectively manage vendor deductions, several strategies need to be adopted. Accurate and timely documentation is crucial. Keep meticulous records of all transactions, dispatch records, and correspondence, as these can be your golden ticket in resolving deductions. Performing regular audits of your internal processes to identify areas of improvement will ensure that you meet Home Depot's stringent requirements.

Understanding Home Depot's benchmarks and investing time and resources to familiarize yourself with it is another practical strategy. Many Home Depot Chargebacks can be prevented by ensuring that product packaging, labeling, and shipping comply with the guidelines and your vendor agreement.

Tools and Resources for HomeDepot Deduction Management

Home Depot Vendor Portal is a crucial resource for vendors dealing with deductions. This online portal offers access to transaction data, order history, and the ability to view and dispute deductions directly.

Thanks to the digital era, there are various technology solutions to simplify the management of vendor deductions. These tools give vendors an upper hand by providing real-time oversight of financial transactions and a time-stamped audit trail.

Introducing iNymbus- Best In-Class Deduction Management Software

Navigating through the myriad of vendor deductions becomes significantly easier with the application of powerful automation solutions. A standout among these is iNymbus, a comprehensive platform specifically designed to manage vendor deductions effectively.

- Robust Automation: iNymbus leverages Robotic Process Automation (RPA). With RPA, the software can automate the vendor deduction process, handling tasks such as data input, validation, dispute lodging, and tracking promptly and accurately. This drastically reduces the potential for human errors and duplicate work.

- Detailed Reporting: The software makes it easy for users to access detailed reports of vendor deductions. You can easily identify trends, and uncover recurring problems, thereby helping in prioritization and strategic planning.

- User-Friendly Interface: With iNymbus, tracking the status of disputes or assessing the overall impact of deductions on business operations across retailers is simple. The intuitive platform allows users to navigate smoothly and efficiently, making the process of managing deductions a less daunting task.

In summary, be it Home Depot Shortages or be it Home Depot Chargebacks, iNymbus can manage them all with ease with its advanced technology.

Ready to transform your deduction management? Get started with iNymbus now and explore our case studies for real-world success stories.

Conclusion

Effective understanding and management of vendor deductions are vital components of a supplier's relationship with this retail behemoth. By being proactive, maintaining accurate records, investing in tools, and complying with Home Depot's established guidelines, vendors can drastically reduce the frequency and impact of these deductions.

Remember, while deductions are a common aspect of doing business with large retailers, with the right knowledge, tools, and strategies, they can be smartly managed to buttress the profitability of your venture.