Ever shipped a full order to a retailer, only to receive a payment that falls short by a few thousand dollars with a vague label like “shortage” or “pricing error” in the remittance note?

Most suppliers have. The goods were delivered. The invoice matched the purchase order. But the payment is incomplete, and the reason is unclear.

These deductions happen more often than most vendors realize. And once the money is gone, recovering it is rarely straightforward.

The problem is not just the missing amount. It is the lack of transparency, the tight dispute windows, and the back-and-forth that eat up hours from your AR team.

This guide breaks down what trade deductions are, why they happen, and how to deal with them before they start cutting into your margins. But first, you need to understand what is being deducted and why.

What Are Trade Deductions?

Trade deductions are payment reductions retailers apply to supplier invoices. They usually fall under predefined codes or vendor agreement policies. While some are valid, such as volume discounts or co-op marketing agreements, others are incorrectly applied or lack documentation.

For example, Walmart might deduct using Code 24 (carton shortage) if a signed freight bill shows fewer cartons received. Target might raise A030 for a unit shortage or A036 for a pricing discrepancy. Amazon issues deductions labeled as shortage claims or compliance chargebacks when an ASN is late or a label is incorrect.

If the supplier does not dispute the deduction in time, it becomes a write-off. Knowing the codes and their meaning is the first step to resolution.

Common Types of Trade Deductions

Each retailer may use different language or codes, but the root causes are often similar:

- Trade promotions: Volume discounts or temporary reductions tied to advertising. Usually agreed in advance, but disputes arise when contract terms are misaligned across systems.

- Shortages: Claims that fewer items were received than invoiced. Walmart’s Code 22 and Kroger’s Code 4 are common for this issue.

- Pricing discrepancies: Deduction triggered when the invoiced unit price does not match the PO. Target uses A036, and Kroger applies Code 3.

- Compliance violations: Includes labeling, packaging, or missed delivery windows. Amazon may flag these as ASN chargebacks.

- Post-audit deductions: Retailers like Home Depot or CVS may audit past invoices and apply retroactive deductions for returns or incorrect pricing.

Each type may require different documentation and handling. Understanding which type of deduction you are facing is the first step in determining your course of action.

If you're looking for common retail deductions and their codes, we've covered them in detail in this blog post.

Why Do Trade Deductions Matter?

Even when deductions are legitimate, they reduce the total amount paid to the supplier. However, invalid deductions can quietly erode margins unless suppliers have systems in place to monitor and dispute them.

In many industries, suppliers report losing 5 to 20 percent of their invoiced revenue to deductions. That translates into significant bottom-line impact, especially for mid-sized businesses with tight operating margins.

Financial Impact Example

A vendor invoices $1 million per quarter to a major retailer. If 10 percent is deducted and 40 percent of that is invalid, the business is losing $40,000 every quarter unnecessarily.

Recovering those funds requires an organized, timely approach to disputing deductions and improving internal readiness.

Why You Should Dispute a Deduction

Disputing every deduction is not always necessary, but ignoring the wrong ones can quietly drain your revenue. Many deductions go uncontested, not because they are valid, but because teams miss the window to act or do not have the right documentation ready.

You should dispute a deduction when:

- The amount withheld does not match your records

- The reason the code is inaccurate or misapplied

- You can prove the order was fulfilled correctly

- The deduction violates the agreed-upon terms or timelines

Each retailer enforces its own rules. Walmart disputes must go through its APDP portal in Retail Link, while Target uses Synergy within Partners Online, and Kroger requires submission via Lavante. Missing these systems or steps can cause delays or rejections.

The Deduction Dispute Process: Step-by-Step

Disputing deductions requires more than sending an email. It is a structured process that involves gathering documentation, responding within a specific timeframe, and following each retailer’s protocol.

Step 1: Identify the Deduction

Monitor retailer systems regularly. Amazon issues shortage deductions through Vendor Central, while Home Depot posts them via Supplier Hub. Note the invoice number, date, amount, and deduction reason code.

Step 2: Gather Documentation

You will need to support your dispute with documents such as:

- Purchase Order (PO)

- Proof of Delivery (POD)

- Bill of Lading (BOL)

- Invoice copy

- ASN confirmation

- Email communication, if relevant

These show the order was shipped correctly and on time. For example, if Target claims A034 (case pack shortage), your POD and case pack label can prove otherwise.

Step 3: Submit the Dispute

Each retailer has a required method. Walmart’s APDP accepts online submissions only. Target’s Synergy platform requires attachment uploads. Include a clear subject line, documentation, invoice references, and the reason the deduction is invalid.

Step 4: Track the Status

Create a tracking system or use software that monitors open disputes, aging, and responses. Many disputes require follow-ups, clarification, or resubmission. Keeping track ensures nothing falls through the cracks.

Step 5: Follow Up and Escalate if Needed

If your dispute remains unresolved after the expected timeframe, escalate it to the appropriate buyer or deduction analyst. Maintain a professional tone and ensure your communication is based on facts and documentation.

Manual vs Automated Deduction Management

At low volume, deduction review may seem manageable. A few short payments here, a few emails there. But this does not scale.

Retailers like Amazon and Walmart use automated systems to apply chargebacks in real time. They expect disputes to be filed by line item and within specific windows. A team member may need 10 minutes to resolve one claim. That does not work when you receive hundreds every week.

Why Manual Processes Fall Short

.png?width=1008&height=410&name=_-%20visual%20selection%20(2).png)

Even large in-house or outsourced teams cannot keep pace with the speed and volume of automated chargebacks. Manual methods are no longer sustainable.

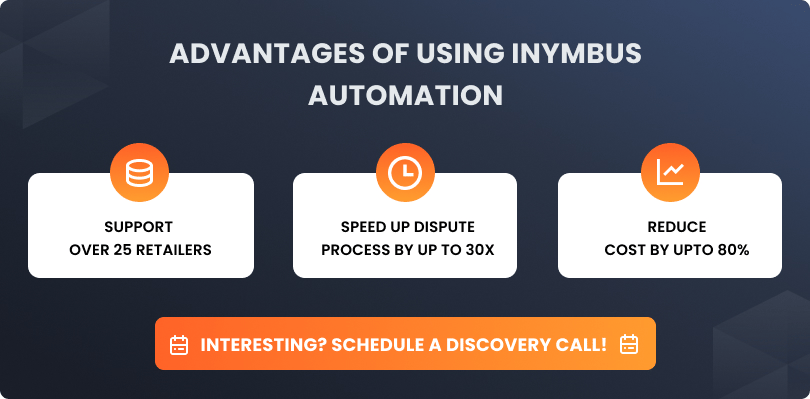

The Case for Automation

Automated deduction tools solve this at scale. They pull deductions from portals, collect documents, and submit disputes faster than any human team.

iNymbus is built for this process. It:

- Scans portals like Walmart Retail Link, Amazon Vendor Central, and Target Synergy daily

- Pulls required files from your TMS, WMS, or ERP

- Auto-generates dispute packets

- Submits them to each retailer’s correct portal

- Tracks dispute progress and resolution rate

By automating the end-to-end process, iNymbus reduces manual effort and helps teams recover more of what they are owed.

How to Prevent And Reduce Future Deductions

While disputing deductions helps recover revenue, long-term success depends on reducing the number of deductions in the first place.

1. Analyze Root Causes

Use dashboards to monitor by code, product, and retailer. Are Walmart shortages rising? Is Target flagging case packs incorrectly? Tools like iNymbus highlight repeat issues.

2. Improve Cross-Team Visibility

Sales should align with finance on promotion timing. Operations should monitor fulfillment data. Finance should own dispute performance.

3. Enhance Documentation Readiness

Standardize the storage and retrieval of PODs, POs, and invoices. Use document management systems that tag and timestamp every file. iNymbus includes automated document collection from TMS and ERP systems, minimizing the time required to compile dispute packages.

4. Monitor KPIs

Track key metrics such as:

- Deduction rate (as a percentage of invoice volume)

- Average dispute resolution time

- Win/loss ratio of disputes

- Dispute aging by status

Next Steps for Vendors and Suppliers

If trade deductions are eating into your margins or slowing down your team, start by reviewing your current process. Map each step from deduction to resolution, and identify gaps in documentation, timing, or ownership.

Begin with a few key actions:

- Track deductions by reason code

- Standardize how documents are stored and labeled

- Review open deductions weekly

- Assign clear roles across finance, sales, and operations

- Assess if automation is needed to handle volume

If your team is falling behind, iNymbus helps automate dispute handling across retailers like Amazon, Walmart, Target, Kroger, and more. You do not need to add headcount or rebuild internal workflows.

With iNymbus, suppliers save time, improve accuracy, and stay ahead of dispute deadlines without growing their team or reworking internal systems.