Ever wonder why so many deductions show up on your invoices from major retailers? If you work with companies like Walmart, Kroger, Target, Amazon, or Home Depot, you’ve likely encountered a wide range of deduction types—from shortages and price discrepancies to compliance issues. These deductions can quickly pile up and leave you scrambling to figure out how to resolve them.

In this guide, we’ll highlight the most common retail deduction types used by these major retailers and provide steps on how to manage and dispute them. Whether you’re looking to prevent future losses or streamline your current process, the insights ahead will help you take control and protect your bottom line.

Common Deductions from Major Retailers

Walmart:

As one of the largest global retailers, Walmart serves millions of customers daily through its extensive network of stores and e-commerce platforms. The company is known for its commitment to low prices and efficiency, relying on a highly automated supply chain to manage inventory and streamline operations.

How Walmart Handles Deductions:

Walmart employs a comprehensive system of over 100 deduction codes, each tied to specific reasons for deductions. Suppliers can manage and dispute these deductions through Walmart’s Accounts Payable Disputes Portal (APDP), integrated with Retail Link.

Common Deductions:

- Code 22: Goods Billed Not Shipped

Applied when Walmart receives fewer items than invoiced (e.g., invoiced for 12 cases but only 10 arrived).

- Code 24: Carton Shortage/Freight Bill Signed Short

Triggered when Walmart's distribution center signs for fewer items than were shipped, often due to transit errors.

- Code 25: No Merchandise Received for Invoice

Occurs when Walmart claims they didn't receive products for an invoice, typically because the invoice was sent before the shipment arrived.

- Code 11: Price Difference Between PO & Invoice

This happens when the cost of items on the invoice doesn’t match what's on the purchase order.

Disappointed that you didn't know about this awesome resource earlier? Don't worry - view All Walmart Deduction Codes.

For Walmart Dispute Process view our guide on Walmart Deduction Recovery.

Target:

Target Corporation operates a large chain of discount stores and is known for its diverse product offerings, including groceries, apparel, and household goods. Target has successfully integrated both in-store and online shopping experiences, creating a loyal customer base.

How Target Handles Deductions:

Target utilizes a detailed system of deduction codes to manage vendor payments effectively. Suppliers can dispute deductions through the "Synergy" platform, which is part of Target's Partners Online.

Common Deductions:

- A030: Carton Shortage

Issued for discrepancies due to carton shortages.

- A032: Damage/Defective

Applied when products are damaged or defective upon receipt.

- A034: Unit/Internal Shortage/Case Pack

Triggered by issues related to unit shortages or case pack discrepancies.

- A036: Cost Difference

Issued for differences between the invoiced amount and the agreed cost.

- A038: Substitution

Applied when an item substitution occurs without prior approval.

- A176: Auto Chargeback

A system-generated deduction for various invoice-receipt differences.

For All Codes - Target Deduction Codes Explained: A Complete Overview

For Dispute Process - Target Deductions: How To Dispute Target Shortages On Synergy

Amazon:

Amazon is a global leader in e-commerce, providing a vast selection of products and services. With its focus on customer experience and fast delivery, Amazon has transformed the retail landscape, setting high standards for vendor compliance and operational efficiency.

How Amazon Handles Deductions:

Amazon manages vendor deductions through its Vendor Central platform. While it doesn’t use specific deduction codes, suppliers frequently encounter common deduction types that emphasize adherence to Amazon's vendor guidelines.

Common Deduction Types:

- Compliance Chargebacks: Deductions related to non-compliance with Amazon’s vendor guidelines, such as incorrect labeling or packaging.

- Shortage Deductions: Applied when Amazon receives fewer items than invoiced.

- Pricing Deductions: Deductions due to discrepancies between the invoice price and the agreed-upon price.

Learn More about Amazon Deductions and Dispute on our Amazon Vendor Central Guide.

Home Depot:

Home Depot is the largest home improvement retailer in the United States, known for its extensive selection of building materials, home improvement products, and services. The company caters to both DIY enthusiasts and professional contractors, driving innovation in the home improvement sector.

How Home Depot Handles Deductions:

Home Depot manages deductions through its Supplier Hub portal, providing suppliers with relevant information about deduction policies, dispute processes, and guidelines.

Common Deductions:

- Invoice Exceptions: Deductions resulting from invoice errors, such as incorrect amounts or missing details.

- ASN Inaccuracy: Deductions triggered by inaccuracies in the Advance Shipment Notice (ASN).

- Home Depot Shortages: Applied when the quantity received is less than what was invoiced.

- EDI Non-Compliance: Deductions for failing to comply with Home Depot’s Electronic Data Interchange (EDI) standards.

For Dispute Process - Disputing Home Depot Deduction Guide

Kroger:

Kroger is a leading grocery retailer in the United States, operating a large network of supermarkets and multi-department stores. Known for its diverse selection of fresh produce, groceries, and household items, Kroger emphasizes quality and customer service while maintaining a competitive edge in the grocery sector.

How Kroger Handles Deductions:

Kroger manages deductions through a structured system that allows suppliers to view and dispute claims via the Lavante Kroger platform.

Common Deductions:

- Code 3: Cost Difference

Issued when there is a discrepancy in the unit price between the invoice and what was received.

- Code 4: Shortage/Damage

Applied when Kroger receives fewer products than invoiced or when products are damaged.

- Code 5: EDI Noncompliance

Issued when invoices are not submitted through the EDI system.

- Code 8: Net Total Difference

Used when Kroger is unable to automatically determine the cause of a discrepancy, whether it’s related to price or quantity.

For Dispute Process - Kroger Deductions-An In-Depth Guide

CVS:

CVS is a prominent pharmacy retailer in the United States, offering a wide range of products, including pharmaceuticals, wellness items, and household goods. Known for its emphasis on health and regulatory compliance, CVS upholds rigorous quality and inventory standards across its supplier network.

How CVS Handles Deductions:

CVS manages supplier deductions through its vendor portal, which allows suppliers to review and dispute deductions. These deductions typically cover issues related to inventory accuracy, compliance with labeling and packaging standards, and product lifecycle management.

Common Deduction Types:

- Returns and Expiry: Applied when CVS returns unsold or expired products to suppliers, which may lead to deductions.

- Shortage Deductions: Triggered when CVS receives fewer items than invoiced, often due to shipping damage, pilferage, or administrative errors.

- Substitution Deductions: Occurs when CVS receives a different item than ordered, particularly sensitive in the pharmaceutical sector where product specifications are exact. Substitution deductions are applied when unapproved substitutes are shipped.

- Pricing Deductions: Issued when there is a mismatch between the purchase order price and the invoice. These deductions can result from outdated pricing data or uncommunicated promotional pricing.

For more info on retail pharmacy deductions - Top 5 Deductions when Selling to Retail Pharmacies

Why Retail Deductions Have Become So Frequent

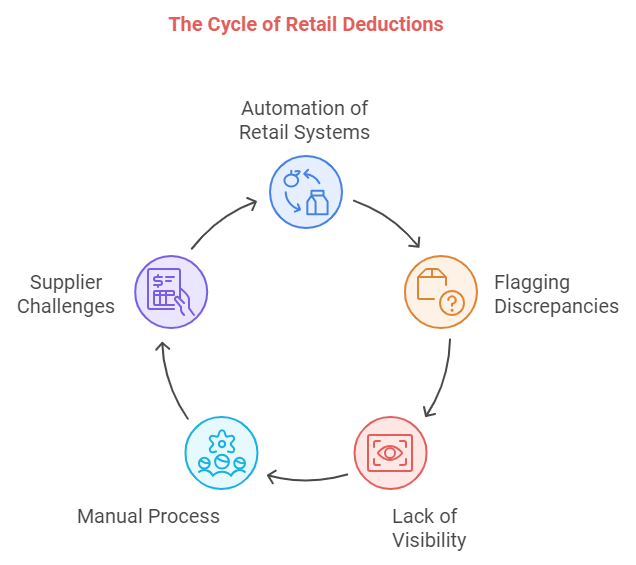

Retailers have increasingly automated their systems to streamline supply chains and ensure compliance with complex operational standards.

These automated systems automatically flag perceived discrepancies, leading to common deductions such as shipment shortages, pricing mismatches, or non-compliance with shipping guidelines.

Unfortunately, this results in many suppliers dealing with a steady stream of deductions, often with little visibility into why they were applied or how to dispute them. Without the right retail deduction management systems in place, managing deductions can become overwhelming.

How to Stay Ahead of Deductions: The Role of Automation

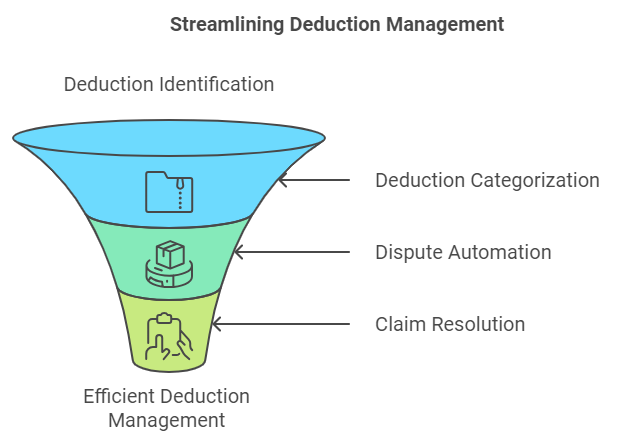

Understanding the common types of deductions and how to dispute them is the first step toward minimizing losses. But in today’s automated retail environment, suppliers need more than just reactive strategies—they need proactive solutions. This is where iNymbus comes into play.

iNymbus provides an innovative, automated approach to managing deductions, enabling suppliers to go beyond simply disputing claims. Instead of manually tracking and responding to deductions, iNymbus automates the process, from identifying deduction types to filing disputes, allowing suppliers to focus on their core operations while staying ahead of the deduction game.

Why Choose Automation?

- Efficiency: Automated systems handle large volumes of deductions without human error, ensuring timely and accurate responses.

- Scalability: As your business grows, iNymbus’s platform scales with you, ensuring that no deduction falls through the cracks.

- Proactive Management: Automation helps identify patterns in deductions, enabling suppliers to fix recurring issues and prevent future deductions before they happen.

Stay Ahead, Not Just Catch Up

With iNymbus, suppliers can shift their focus from reacting to deduction claims to staying ahead. Instead of waiting for deductions to pile up and affect cash flow, iNymbus allows businesses to streamline their dispute process, minimize losses, and maintain strong retailer relationships—all while saving time and resources.